Monthly Market Update

Submitted by TLWM Financial on December 3rd, 2024_0.png)

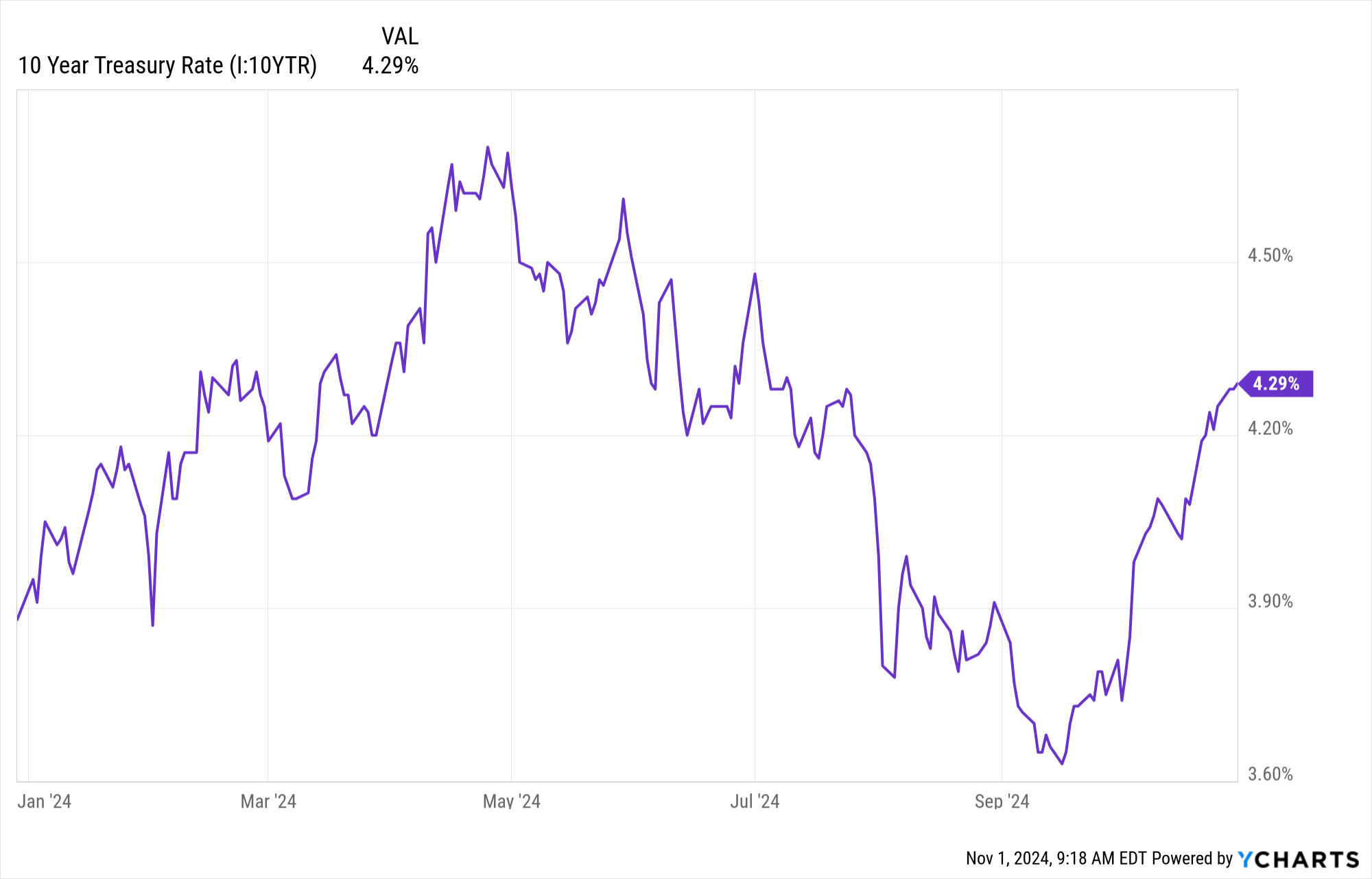

November was an eventful month for investors as the S&P 500 moved higher, finishing the month up almost 6%, and is now up roughly 26.5% for the year. (YCharts) The biggest market mover was the US election, while we also had a busy month of positive corporate earnings, and a Fed rate decision (0.25% rate cut).

Post election, we made adjustments to portfolios to try to take advantage of areas that we feel may have sustained tailwinds given the likely policies from a Trump administration and Republican Congress. Below we’ve highlighted a few areas of the market we like moving forward.

.png)

- YTD 9.30.24.png)

YTD 8.30.24.png)