2020 TLWM Annual Outlook

Submitted by TLWM Financial on December 13th, 2019TLWM Annual Outlook – 2020

2019 has been a good year for stocks around the globe as major indices are solidly in positive territory led by the S&P 500 which is up approximately 25% through December 10th. These returns have been welcomed by investors after enduring a difficult end to 2018 as stocks fell almost 20% during the 4th quarter of last year. In fact, since the lows of 2018 the S&P 500 index has rallied more than 30%. (YCharts)

As we look forward to a new year and decade, many of the challenges we faced over the last 12 months continue to linger while the bull market ages another year. We are currently in the longest bull market expansion ever (Bloomberg), and investors are left to wonder if the end is near. While we don’t believe bull-markets die of old age, we are mindful of where we are in the economic cycle. The fact that we’re likely closer to the end of the cycle than the beginning combined with deterioration in our economic dashboard makes us view 2020 cautiously. We feel the chances of a recession over the next 12 months is higher today than it was at this time last year. In addition to the underlying economic data, a number of uncertainties have the potential to impact markets. We have outlined a few of these below:

Trade:

The ongoing US-China trade war might be viewed by many investors as the most important issue for the economy and stock market in 2020 and beyond. The trade war may have been weighing on investors and businesses for the past couple of years and while it appears some progress has been made recently, hopes are pinned on a “phase one” trade deal that may or may not mark significant progress in relations between the US and China. One bright spot for trade was the recent signing of the USMCA, a revamp of the 1994 NAFTA agreement.

Trade uncertainty has probably hampered global economic growth this year. In the US we have seen economic growth slow from 2.9% in 2018 to a projected 2.2% for 2019 (Fed). Slowing growth has taken a toll on corporate earnings with 2019 projected earnings growth of only 0.2% for the S&P 500. (Factset) 2020 earnings growth expectations are currently 9.8%, which would be a much-welcomed improvement as earnings growth likely needs to improve for stocks to move higher. (Factset)

The slowdown in growth has been blamed by many on the reluctance of businesses to spend on expansion plans due to the ongoing trade uncertainty. Despite this headwind, the US economy has been able to continue to expand due to a strong US consumer, but how long can the consumer carry the load? A resolution to trade uncertainty and a return to business spending could help extend the economic cycle and allow economic growth to be less reliant on the consumer. In turn, a further deterioration in trade could have the opposite effect, and could lead to an environment where we believe the chances of recession would likely increase.

Economic Dashboard:

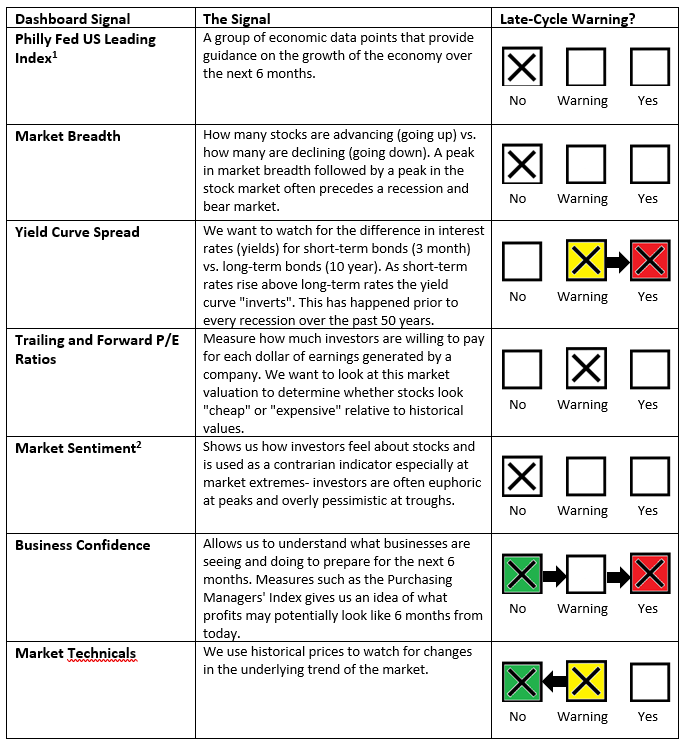

Our economic dashboard consists of seven indicators that have been good signals ahead of a recession. Over the course of this year we have seen the dashboard deteriorate with two elements now flashing red: yield curve and business confidence (these changes can be seen in our dashboard graphic below). We believe that these developments signify an increased chance of recession over the next 9-12 months and justify a reduction of risk in the equity portion of our portfolios. As we look to next year, we will be watching our dashboard closely and will stand ready to make further changes to portfolios as the economic environment changes.

Yield Curve

The first dashboard element that turned red this year was the 10 yr.- 3-month yield curve. The yield curve inverted in March as short-term interest rates (3-month yield) rose above long-term rates (10 yr. yield). Since the initial inversion, the Fed has cut interest rates 3 times which has pushed short-term rates down. This, along with long-term yields moving higher over the past couple of months, has led to a re-steepening and un-inversion of the yield curve. While this indicator is not a good timing indicator, it has historically been a consistent predictor of a recession.

Business Confidence

The other element of our dashboard that has changed to red this year is our business confidence indicator, tracked by the ISM Manufacturing PMI Index. This indicator has historically been a good predictor of businesses’ profits over the next 6 months. When the reading is above 50 it signals expansion, while a reading below 50 signals contraction. The PMI readings have been trending downward this year and over the past 4 months the reading has been below 50. Both the trend and level of the index are concerning as this could be an indication of weakness ahead.

So, where does our dashboard go from here? There are many uncertainties that could impact our dashboard in a positive or negative way, with a big factor being trade. While we can’t predict what will happen over the next 12 months, we will be monitoring our dashboard closely for any further deterioration (or improvement) as our dashboard helps guide our portfolio positioning.

Central Banks:

The Federal Reserve entered 2019 amid a rate hike cycle despite concerns about economic growth. In hindsight it appears the Fed moved too quickly as stocks suffered a roughly 20% pull-back at the end of 2018 amid fears of economic contraction. The Fed changed course throughout the year, eventually cutting rates three times in an effort to stimulate growth. As we look to 2020, we will likely find out whether or not those cuts were enough to re-energize economic growth. Many investors hope that these cuts end up being a “mid-cycle adjustment” rather than a sign that the economy is heading toward a recession.

Central banks around the globe will likely face challenges in 2020 as accommodative policies and rate cuts have resulted in over $12 trillion dollars of negative yielding debt as of mid-November (Bloomberg). Essentially, this means that investors are willing to lose money on those loans. This unique challenge has been present for a number of years and central banks will continue to wrestle with this issue.

Election Year:

As we move into an election year with a crowded field of candidates it’s likely we’re going to have uncertainty around the election which could impact stocks. As the year progresses, a clearer picture on potential outcomes should emerge. During each election cycle we often see policy debates focus on a few key areas of the economy. These sectors may see increased volatility due to heightened uncertainty and potential regulatory changes. Based on initial campaigning some sectors to keep a close eye on throughout 2020 are health care, financial services, and technology.

We won’t try to make any predictions (we know better than that!), but the stock market may give us a clue as to the likely outcome. Per LPL Financial, “...when the S&P 500 was in the green three months before the election, the incumbent party tended to stay in the White House. If stocks were down, this potentially signaled an upcoming change in power in the White House.” While not perfect, this method has accurately predicted the outcome in 20 of the last 23 presidential elections.

Wild Cards:

While we have outlined what we feel are the most important areas to watch there are almost always unexpected developments and 2020 will likely be no different. Here are a few wild card events that have potential to impact the markets, but also may end up as non-events:

Brexit: The UK’s pending divorce from the EU has weighed on sentiment since the Brexit referendum in 2016. The recent UK general election may provide some clarity, but we wouldn’t be surprised to see more curve-balls as the next deadline draws near.

Impeachment Hearings: While the impeachment process moves forward, the general consensus is that there is a very low probability President Trump will be removed from office. While this is unlikely to move markets, we will watch for any surprises.

Geo-political Risks: There was no shortage of geo-political risks throughout 2019 and we have no reason to think 2020 will be any different with potential risks around the globe including increased tensions in the Middle East, Russia, China, and North Korea.

Asset Allocation & Financial Planning

The uncertainties mentioned above reinforce the need for a dynamic and flexible approach to investing. Our investment philosophy is rooted in our risk management process. When we believe the level of risk is too high, or that a recession is imminent, we have the ability to take action to try to preserve your assets. The goal of this strategy is to protect your portfolio and have capital on hand to invest when new opportunities arise. We believe that having this flexibility is critical, particularly in a year where the strength of the economy and market may hinge on the outcome of a few key events.

We enter 2020 with the belief that the odds of recession over the next 9-12 months have increased. As such, we made changes in portfolios throughout the 2nd half of 2019 to reduce risk and position our strategies a little more cautiously at this time. We will continue to monitor the current economic environment and major market moving developments closely and will be ready to make further changes as needed.

While our investment philosophy will help determine the level of risk in the growth-oriented portion of portfolios, determining the right overall asset allocation is critical to make sure that you don’t have too much (or too little) risk. Our financial planning process allows us to determine an appropriate asset allocation that seeks to maximize the chances of meeting your goals. In addition to ensuring you are allocated appropriately this process also helps us determine a purpose for every dollar and ensure we leave no stone unturned when it comes to pursuing your long-term goals and objectives.

We wish you and your families a wonderful holiday season and a happy and healthy 2020.

*Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following developed country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK.

*Investing in foreign securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.

* The price-earnings ratio (P/E Ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

*Asset allocation does not ensure a profit or protect against a loss.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

1 These Leading Indices predict each state's coincident index growth rate for six months. Estimates are based on a vector autoregression model along with state-level housing permits, initial claims for unemployment insurance, delivery times from the ISM manufacturing survey, and interest rate spreads between 3-month and 10-year treasuries. There is also a US national prediction. (YCHARTS)

2 The put-call ratio is an indicator ratio that provides information about relative trading volumes of an underlying security's put options to its call options. The put-call ratio has long been viewed as an indicator of investor sentiment in the markets, where a large proportion of puts to calls indicates bearish sentiment, and vice versa. (Investopedia)