2021 TLWM Annual Outlook

Submitted by TLWM Financial on December 14th, 2020.jpg)

TLWM Annual Outlook – 2021

2020 has been filled with remarkable challenges as the global pandemic has upended life in ways that were unimaginable a year ago. Those challenges arrived suddenly with the economy’s abrupt shutdown, subsequent recession, and bear market in stocks during the 1st half of the year. The pandemic’s impact is likely to be felt for years to come as it has changed the way we live, work, and communicate.

As we look toward 2021, we believe that there is light at the end of the tunnel demonstrated by the substantial economic improvement in the 2nd half of this year, along with promising developments in treatments for COVID-19 and the arrival of much anticipated vaccines. Investors appear to believe that the future is bright as the unprecedented drop in stocks at the beginning of this year has reversed and stocks have made an incredible move higher since the lows in March, with the S&P 500 up roughly 13% for the year (through Dec 11th). (YCharts)

The Economy:

In last year’s annual outlook, we warned that the chances of a recession were growing as the economic expansion was aging and we were beginning to see some deterioration in our economic dashboard. While we had a recession during 2020, it shared few characteristics of previous economic contractions as the global economy was essentially shutdown overnight. US GDP dropped by an annualized 5% in the first quarter, and then 30% in the second quarter. That was followed by a jump of 33% in the third quarter as the economy began to re-open. We expect to see the economy’s recovery continue throughout 2021 as vaccines become widely available and we continue to learn more about how to live with COVID-19. We also believe that monetary and fiscal policy will continue to play a major role in supporting the economic recovery (more on those topics below).

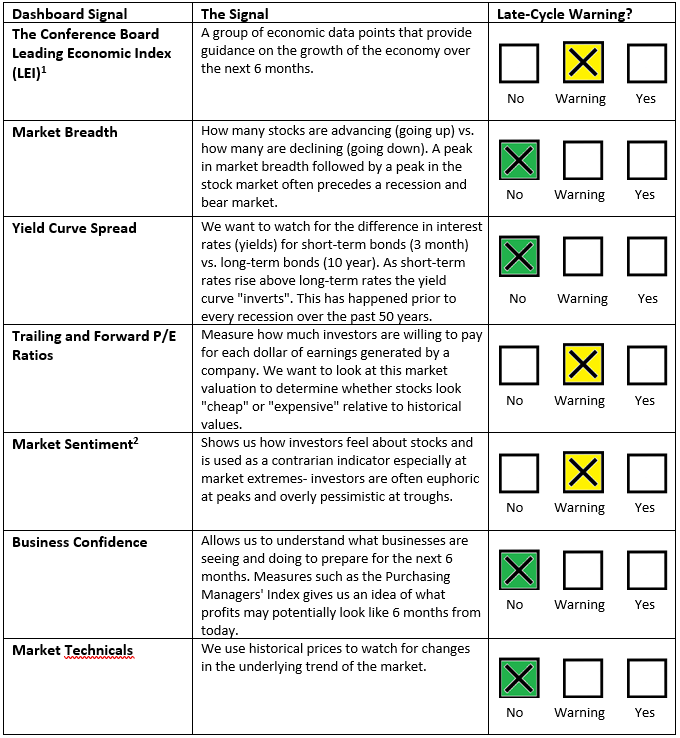

Improvements in our economic dashboard also suggest that the ongoing economic recovery has the potential to continue. We upgraded many of our indicators during the back half of 2020 and believe that our dashboard suggests limited odds of a recession in the near future; although, given the unprecedented nature of COVID-19’s impact on the economy surprises could lie around the corner.

Monetary Policy:

A major story for financial markets in 2020 has been the enormous support from central banks around the globe. We expect this to continue in 2021 and beyond. Federal Reserve Chair, Jerome Powell, indicated this in a policy meeting during the summer by saying, “We’re not even thinking about thinking about raising rates.” (Wall Street Journal). This pledge of support from the Fed is likely to keep interest rates low, and provide key support as the economy continues to rebound.

Fiscal Policy:

The federal response to the economic shutdown was massive with fiscal measures that included stimulus checks, an expansion of unemployment insurance, and financial support for businesses. While the recent negotiations have left Congress struggling to reach a consensus on another round of coronavirus relief there appears to be some agreement that additional stimulus is necessary. We feel that more stimulus is likely (maybe in early 2021) and that this economic support should help keep the economic recovery moving.

Political Drivers:

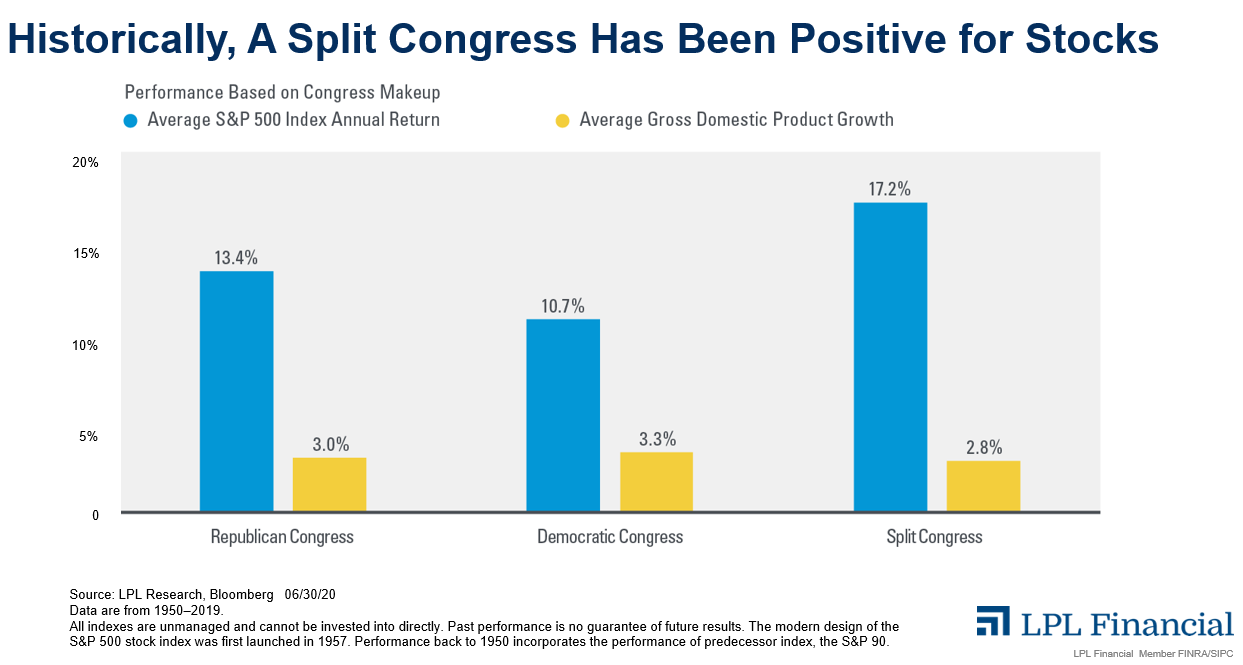

The 2020 election is not quite over with the Senate runoffs in Georgia, scheduled for January 5th, left to determine control of Congress. We won’t make any effort to predict the outcome of those races, but will be watching closely. If the Republican candidates win one of those two races, we’ll end up with a split Congress which has historically been the most favorable environment for stocks. If the Democrats were to take both seats then Democrats would have control over the House and Senate, with the vice president casting any tie-breaking votes. While each of these environments may have different policy implications, we don’t believe that either outcome would drastically alter the path of economic recovery.

Corporate Earnings:

The stock market recovery in the 2nd half of the year saw stocks hit all-time highs, while corporate earnings remain a long way from their pre-pandemic levels. That’s normal as investors are counting on a continued economic recovery and anticipating much improved earnings in 2021 and 2022. Forecasting earnings can be a difficult exercise in the best of times, but expectations have been improving for the next 24 months. Corporations have appeared to manage the current environment somewhat successfully as we’ve seen 85% of S&P 500 companies beat expectations in the third quarter. (FactSet) Corporate earnings and future guidance can give us a sense of how companies are adapting to the current environment, and we’ll continue to watch earnings closely as we move into 2021.

Fixed Income

The 10-year US Treasury yielded 0.92% as of December 9th after beginning the year at 1.92% and dropping to a low of 0.52% in August. (YCharts) Rates initially plummeted in March as investors fled to the perceived safety of US Treasuries, but have slowly drifted higher over the last few months. As we outlined earlier, central banks have intervened with the goal of keeping rates down and we believe that we are likely to remain in a low interest rate environment next year which should benefit both borrowers and equity investors. For borrowers, low interest rates create an incentive to borrow funds (think low mortgage rates) and drive economic activity. For investors low bond yields, and limited returns make other asset classes (including stocks) appear more attractive and may help support current stock-market valuations.

Our financial planning team works with each of you to determine an appropriate asset allocation in line with your risk tolerance, goals, and income needs. While bonds may not provide a huge boost to returns given current low interest rates, we believe they play a critical role in portfolio construction. During times of stock market volatility, a bond allocation is designed to dampen that volatility and provide a smoother ride. While the low interest rate environment presents some unique challenges, we will continue to adjust our fixed income allocation to try to take advantage of opportunities as they arise.

Asset Allocation & Financial Planning

Our investment philosophy is anchored by our risk management process which we utilized this year as we reduced our equity exposure during a period of time that we felt presented significant risk to portfolios. Fortunately, we are now in a position where we feel that the economic recovery is likely to continue into 2021 and beyond. We are now fully invested in the growth portion of portfolios and will attempt to take advantage of the investment opportunities that lie ahead.

While our investment philosophy will guide us in determining the level of risk to take in the growth-oriented portion of portfolios, our financial planning team works with each of you to determine an appropriate overall asset allocation, and provide ongoing planning guidance. We believe that having a sound financial plan is necessary to determine a purpose for every dollar and maximize the chances of reaching financial goals. We come to work every day with the goal of helping you and your family reach your financial goals so that you can focus on what’s most important to you.

This year has certainly been a challenging one for all of us. We are thankful to work with each one of you and look forward to (hopefully) seeing you in person next year! We wish you and your family a wonderful holiday season and happy and healthy 2021.

1 The Composite Index of Leading Indicators, otherwise known as the Leading Economic Index (LEI), is an index published monthly by The Conference Board. It is used to predict the direction of global economic movements in future months. The index is composed of 10 economic components whose changes tend to precede changes in the overall economy. (Investopedia)

2 The American Association of Individual Investors (AAII) is an investor education organization. The sentiment survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term; individuals are polled from the AAII Web site on a weekly basis.

*Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.

* The price-earnings ratio (P/E Ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* No strategy ensures a profit or protects against a loss.