2022 TLWM Financial Annual Outlook

Submitted by TLWM Financial on December 20th, 2021

TLWM Financial – 2022 Outlook

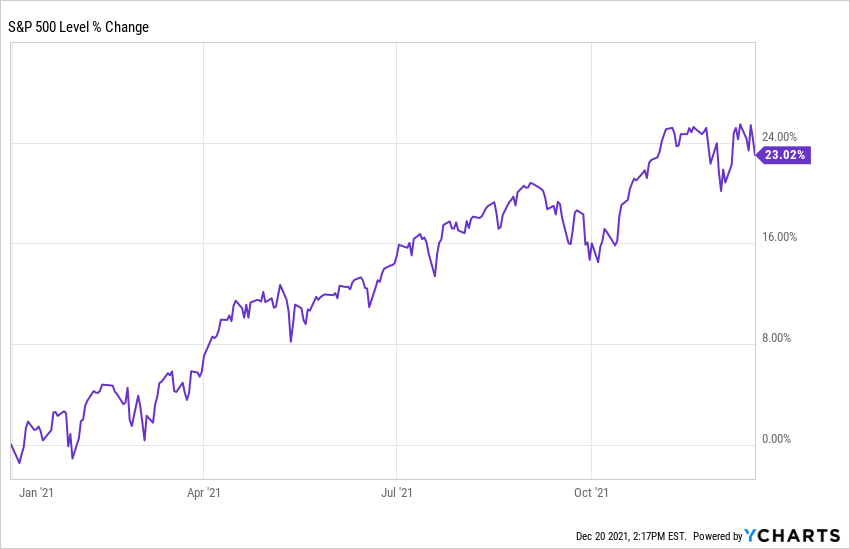

For the second December in a row, we look back at a year dominated by the impact from and response to a global pandemic. In last year’s outlook we suggested that we were beginning to see light at the end of the tunnel. Thankfully, in many ways this was true as kids are back in school, families once again gather for celebrations, economic growth was robust, and stock market returns were strong.

While we are undoubtedly in better shape today than a year ago, 2021 presented many challenges that remain with us and will likely shape the path of economic growth in 2022. Most notably, these challenges include supply chain disruptions, a rapidly changing labor market, and inflation. In this outlook we will discuss key themes to watch in 2022 as we look forward to the next phase of recovery.

The Economy & Our Economic Dashboard:

Economic growth was strong in 2021 with US GDP estimated to grow at a rate of approximately 5.5% for the year. (LPL Research) As we look toward 2022, we believe that economic growth is likely to continue, although probably at a slower pace.

Our economic dashboard is made up of seven factors. Currently, five of these seven indicators are flashing green – pointing toward ongoing economic growth. This includes particularly strong readings in LEI (Leading Economic Indicators), and in manufacturing (PMI Manufacturing Index).

The two areas that are flashing yellow (not red), are stock market related: valuations and market breadth. While stock market valuations are higher than the historical average, we’ve seen valuations come down slightly this year as corporate earnings have strengthened at a healthy pace. Market breadth is a measure of how many stocks are participating alongside the broader market indices, and we haven’t seen as much participation as we’d like over the last few months. We’ll be keeping a close eye on all seven indicators, but particularly breadth and valuation moving into ’22.

Monetary Policy:

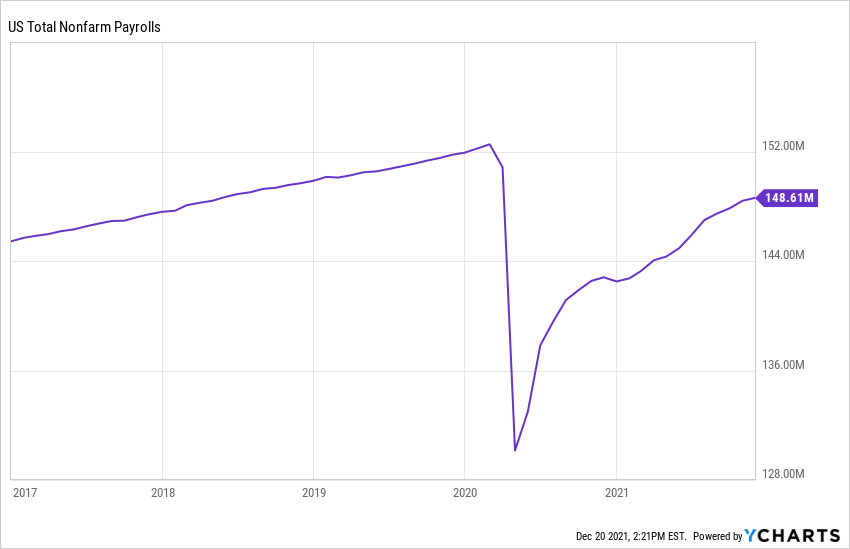

The Federal Reserve’s response to the economic shutdown was big and bold. The focus moving forward will be on how the Fed adjusts monetary policy now that the economy seems to be on steady footing, the labor market is much improved, and inflation persists.

In November the Fed announced that they will taper their bond purchases (purchase fewer bonds) each month. Shortly after that announcement Chair Powell suggested that they may increase the pace of the taper. This surprised markets at first, and led to some short-term market volatility. Investors tend to dislike surprises, so it will be important to watch Fed policy and communication throughout the year to get a sense of how monetary policy changes.

Fed watchers are particularly concerned with the timing of rate hikes as a shift to tighter monetary policy is a sign that the Fed is ready to tap the brakes on economic growth. Right now, market expectations are for the Fed to begin raising rates sometime in the middle of 2022. (CME FedWatch Tool)

Inflation:

Early in the year the Federal Reserve suggested that inflationary pressures may be transitory, as many of the underlying causes appeared to be related to the challenges in re-starting the economy. As the year continued, it became clear that a combination of supply chain challenges, a tight labor market, and the resulting shortages were going to cause higher inflation to stick around. As we look to ’22 we believe that many of these pressures are likely to decrease throughout the year, but it may take some time to get back to normal. Lingering inflationary pressure could impact everything from the consumer to the Federal Reserve.

COVID-19:

Clearly the most impactful event of the last two years for all of us personally and for the economy has been COVID-19. We’ve seen variants emerge with differing impacts on the economy and markets. While there is no way to forecast another variant or the potential impact, we feel that we are in a far better place today than at any time over the last 18+ months with the development of vaccines, treatments, and our overall understanding of COVID-19 and how to live with it.

Other Factors to Watch: While we believe that economic growth, inflation, monetary policy, and COVID-19 may be the most significant drivers moving into 2022 we’re also keeping an eye on many other factors including:

The Consumer: the consumer has played a major role in driving economic growth over the last year as retail sales have been strong – it will be important to see this trend continue in ’22.

Corporate Earnings: 2021 was a banner year for earnings with earnings growth estimated to hit 45% for the year (FactSet). The 2022 outlook is bright with analysts projecting earnings growth of 8.8%.

Fiscal Policy: We will be watching how fiscal stimulus plays out in 2022 along with potential tax changes that may accompany it.

Political Risks: All eyes will be on the build up to mid-term elections in November and we’ll be watching for any surprises coming from DC.

Geo-political risks: There is always the risk of geo-political surprises and the recent increase in tensions with Russia is a reminder of that risk.

Unexpected: Of course, surprises may be waiting around the corner so we will be on our toes as unexpected events can often have the biggest market impact.

Market expectations:

Stocks: after a big rally for stocks in 2021 we expect stock market returns are likely to moderate as we move into 2022. We feel that continued economic growth and solid corporate earnings are likely to drive stocks higher in the mid-to-high single digit range. That said, we wouldn’t be surprised to see volatility pick up as there are a number of challenges for investors to navigate.

Bonds: In 2021, bonds had a tough year compared to stocks. As we look to next year, we think that bond yields are likely to drift higher as economic growth continues, inflation pressures remain, and the Fed considers rising rates.

Portfolio Positioning and Financial Planning:

We continue to position portfolios for growth and are fully invested given our outlook for stocks next year. We are always ready to make adjustments to portfolios and reduce our equity exposure if we feel we are entering a period of time where there are significant risks. The most common reason to reduce risk is if we believe the chance of a recession rises significantly.

While our economic outlook and investment philosophy will guide us in determining the level of risk to take in the growth-oriented portion of portfolios our planning team works with each of you to determine an appropriate overall asset allocation. Over the last year we have worked with many of you on a variety of financial planning questions and recommendations. Planning is at the core of what we do and we believe the combination of sound financial planning and proactive investment management allow us to try to maximize the chances of reaching your financial goals.

We are thankful to work with each of you and wish you and your family a wonderful holiday season and a happy and healthy 2022!

*Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* No strategy ensures a profit or protects against a loss.