Market Mover - Earnings

Submitted by TLWM Financial on November 18th, 2016This year investors have had to face a number of curve balls. Brexit, Federal Reserve rate hikes, the US election, and a slowing global economy have grabbed headlines throughout the year. Despite that noise (and legitimate concerns) it's important to remember a couple of variables that can often move stocks higher (or lower): earnings, and earnings expectations. In purchasing stocks we buy a share of potential future earnings.

Each quarter investors eagerly await earnings season - a month in which the majority of corporate earnings are released to the public. Investors digest those results and accompanying explanations to analyze past performance and assess what the future may hold. By looking at earnings and revenues for the prior quarter we get to see how much money is being made for shareholders. If the quarter is better or worse than expected investors want to know why. Understanding the story behind a company's quarterly earnings helps us think about where to invest and what to expect in the future.

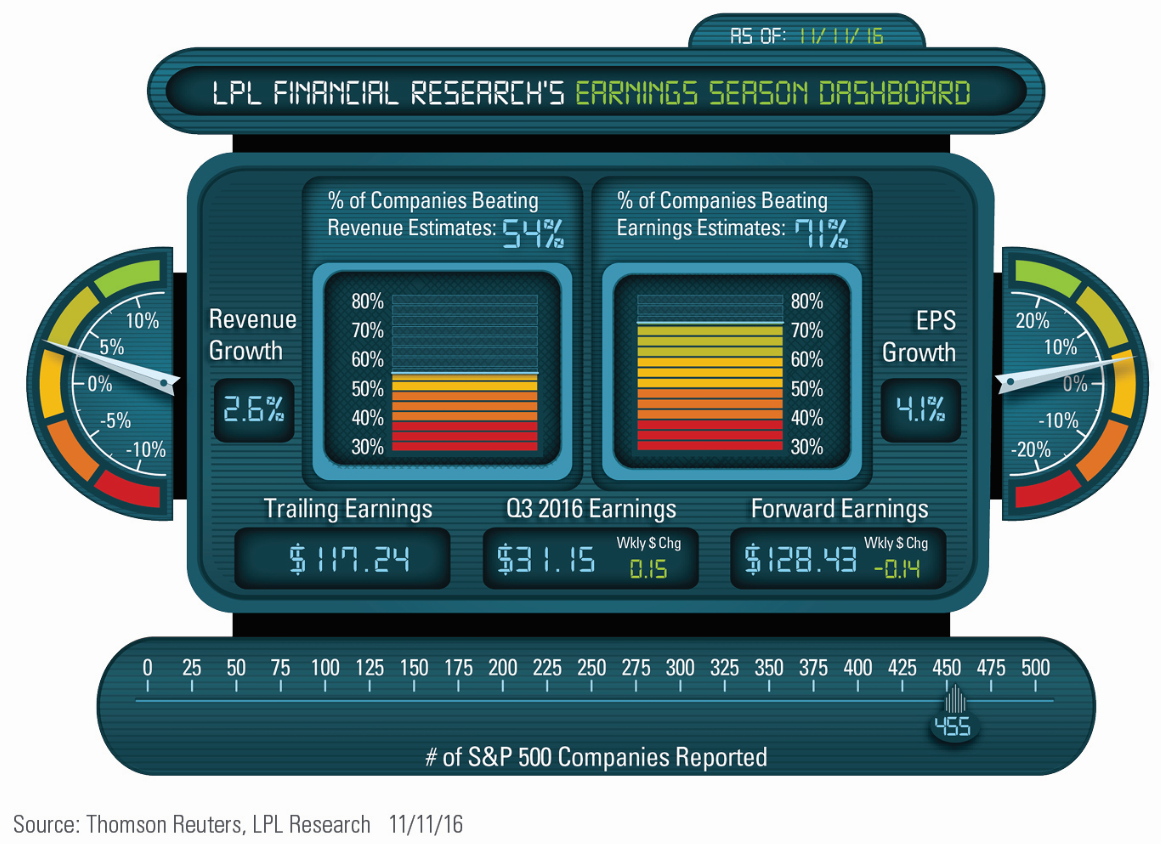

Why is this earnings season so important? After five quarters of year-over-year earnings declines the wait for earnings growth is over with earnings up approximately 3% for the quarter (according to Factset). The future looks bright with earnings expected to grow at an 11.4% rate in 2017 giving hope that earnings growth could drive the market higher. Here is a snapshot of the third quarter earnings season which has been better than expected thus far:

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* The price-earnings ratio (P/E Ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.