Market Mover - Investing Internationally

Submitted by TLWM Financial on January 26th, 2017As we mentioned in our 2017 Annual Outlook, we see a potentially improving outlook for international stocks and thus continue to maintain exposure to both US and international equities. We believe the following factors warrant that exposure: attractive valuation, improving overseas earnings and fundamental economic data.

1) Valuation:

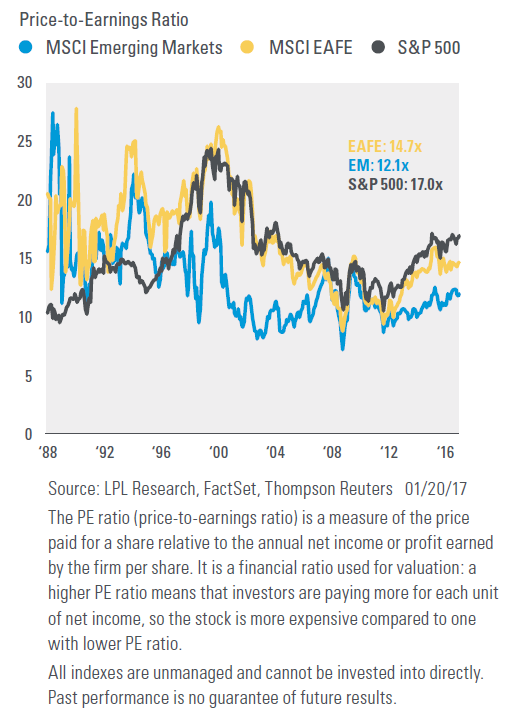

The US market has substantially outperformed most international markets over the last few years. Amid this rally, US stocks have become more expensive demonstrated by higher P/E's. The divergence in forward P/E's between the US and international markets, as seen in the LPL Research chart below, shows international equities seem to be more attractive on a relative basis as they now look potentially cheaper than normal when compared to US stocks. With US markets continuing to trade near all time highs we may see investors look overseas for value.

2) Overseas Earnings:

According to LPL Research, after years of declining corporate earnings international earnings have begun to grow again, and are expected to continue to do so. LPL also expects that a stronger U.S. economy, boosted in part by tax cuts, fiscal spending, and deregulation could boost the global economy and therefore international companies. Higher earnings expectations for foreign corporations could bode well for international equities.

3) Economic data:

We have also seen an improvement in fundamental data potentially signaling a pick-up in global growth. One measure of this is manufacturing data around the world. The Purchasing Manufacturing Index (PMI), a measure of manufacturing activity, in Europe continues to improve. The most recent reading of 54.4 was better than expected and over the 50 level, which signals expansion. This was the best reading since April 2011. (Markit Economics) We have also seen improvement in China's PMI as last month it rose to 51.9, better than expectations and prior readings. (Markit Economics)

We believe that attractive valuations, along with an improved outlook for earnings and fundamental economic data could bode well for international companies as we move into 2017. While we are cautiously optimistic on international stocks there are many potential headwinds including: political change, protectionist rhetoric, and diverging monetary policy. Specifically, we wouldn't be surprised to see volatility surrounding Brexit negotiations, upcoming European elections, Trump's possible trade policies, and the Fed's path to raising rates. Each of these factors have the potential to impact international investments, positively or negatively. We will be closely monitoring all of these events throughout the year and be ready to make changes to our portfolio allocation as dictated by an evolving economic environment.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* The price-earnings ratio (P/E Ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* International and emerging market investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.