Monthly Market Update

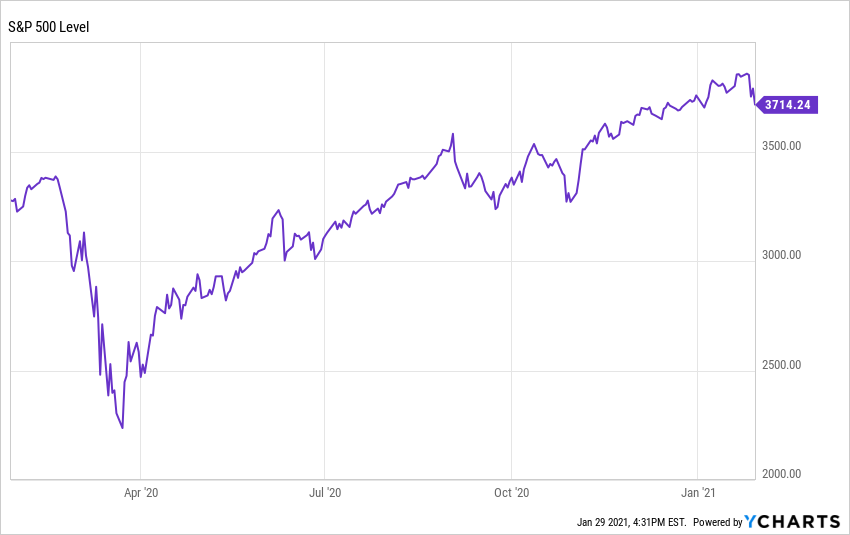

Submitted by TLWM Financial on February 1st, 20212021 began just like 2020 ended with stocks moving higher. There were plenty of headlines to worry about throughout the month as we transitioned to a new administration and COVID-19 cases jumped after the holidays. Despite these risks, investors appeared to remain focused on the positives, as stocks hit all-time highs, before reversing course the last few trading days of the month; the S&P 500 ended January down roughly 1% (YCharts).

After such an impressive market rally (since last March) many investors have asked, “can stocks possibly go higher from here?” This concern may be heightened due to the ongoing global pandemic, the fact that we are still in the early stages of an economic recovery, and the economy isn’t yet firing on all cylinders. Even with these risks, here are a few reasons the market may continue its path higher, although we will likely see more volatility along the way.

Stocks are considered a leading indicator: Stocks usually move in anticipation of the economy getting better (or worse) and many investors see the current recovery accelerating in the second half of 2021. This is perhaps best illustrated through corporate earnings as 2021 earnings are currently forecasted to bounce back from last year’s plunge, and surpass 2019’s results. (FactSet)

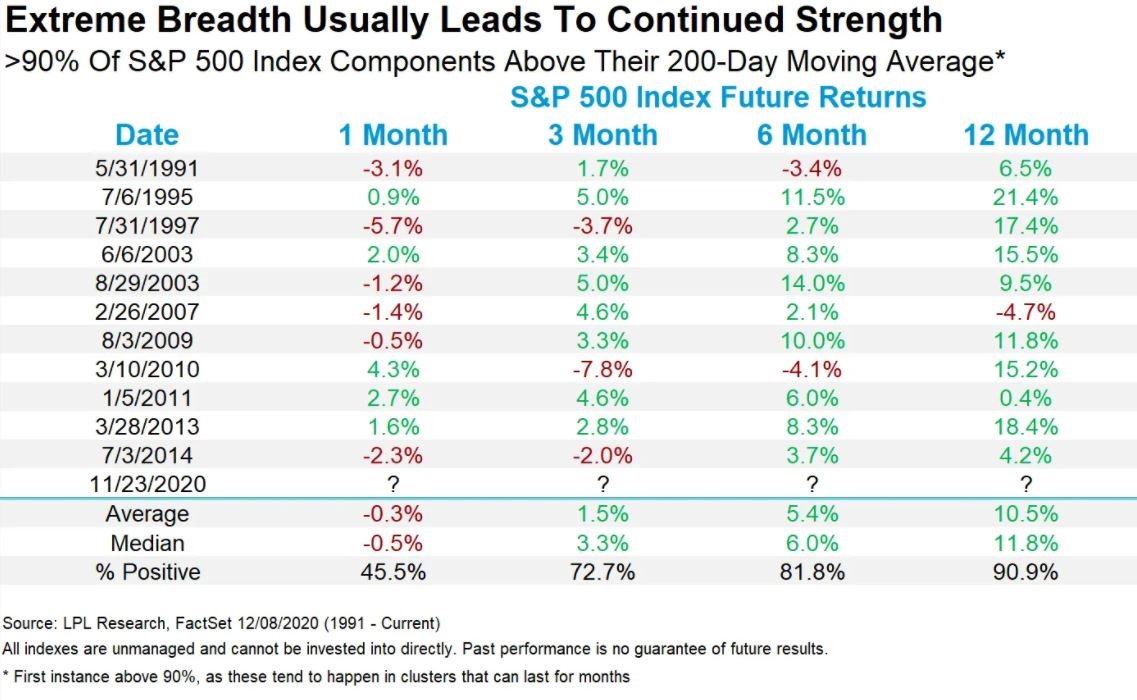

Strength begets strength: While many investors may be afraid of heights after large market rallies, the data tells a different story. Strength often leads to more strength as demonstrated by the chart below. While this may not always be the case, this data suggests that market strength shouldn’t be the sole reason to sell stocks.

T.I.N.A.: This acronym for “there is no alternative” has been used by many to explain current stock market valuations. When investors are faced with extremely low interest rates (ex: the US 10 Year Treasury is yielding roughly 1% (YCharts)) then stocks appear more attractive on a relative basis, and investors are willing to pay more.

Volatility is to be Expected: Quite often after an extended rally, we see stock market volatility. A pull-back or market correction wouldn’t be surprising at this stage, and while it may feel uncomfortable it would be a normal and healthy event. We don’t try to time short term market movements, but we do work with each one of you on your overall asset allocation to try to smooth out these periods of volatility.

As we look toward the rest of 2021 our dashboard suggests that the economic recovery is likely to continue and that a recession in the near term is unlikely. As such, we have portfolios positioned for growth, but will continue to watch for developments that could alter that outlook and be ready to make necessary changes.

Sincerely,

Your Team at TLWM

*Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* No strategy ensures a profit or protects against a loss.