Monthly Market Update

Submitted by TLWM Financial on April 1st, 2021

The market had a good start to 2021 with the S&P 500 up almost 6% for the quarter, after rallying about 4% in March. March 23rd marked a full-year from the bottom of last year’s bear market. The future seemed bleak as stocks dropped over 30% amidst uncertainty around COVID-19. Since that time, stocks have done what may have felt unthinkable at that moment – they have rallied over 70% as measured by the S&P 500 (YCharts).

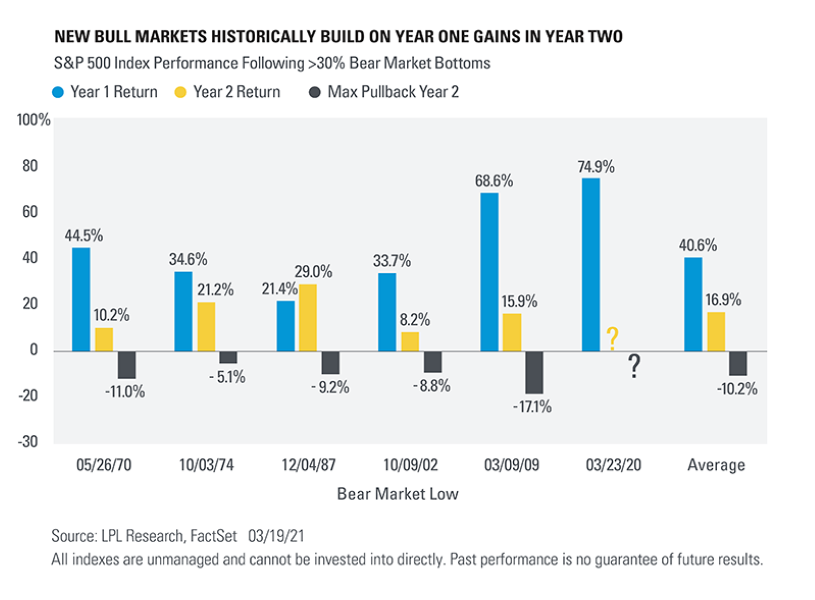

After a market rally of this magnitude the question becomes: is the current market rally sustainable? History tells us that there is no reason to fear the second year of a new bull market. Per LPL Financial, there have been six other bear-market declines of at least 30% and after a strong first year stocks were also up the second year of a new bull market, averaging 16.9%.

While history is a good guide, we need to look beyond the historical data. There were a number of important developments during March that we feel provide reason to be optimistic:

- The Fed: The Fed’s meeting in March provided no major surprises with Fed Chair Jay Powell continuing to strike a highly accommodative tone as the Fed sees an improving economy yet has no plans to hike rates in the next year or two.

- Stimulus: President Biden signed into law a $1.9 Trillion COVID-19 stimulus bill which included direct checks, jobless aid, money for schools and vaccine distribution. This fiscal stimulus is likely to provide a tailwind for the economy throughout this year.

- COVID-19: vaccinations continue to increase across the US while case numbers and hospitalizations have significantly dropped over the last few months. This has the potential to lead to a continued pickup in business activity.

While our outlook continues to be positive, we would not be surprised to see some volatility throughout the year as pullbacks are common during the second year of a bull market. (LPL Financial) We will continue to watch the market and economy closely and be ready to make adjustments to portfolios as needed.

Sincerely,

Your team at TLWM

* Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* No strategy ensures a profit or protects against a loss.