Monthly Market Update

Submitted by TLWM Financial on May 4th, 2021

The stock market’s strong momentum continued in April as stocks once again rallied to new all-time highs. For the month, the S&P 500 was up about 5%, which now puts the index up over 11% for the year. (YCharts)

For the last few months strong economic data has boosted expectations for economic growth in 2021 and beyond. This was the case yet again as the following data, reported in April, painted an improving picture:

- Retail Sales soared as the most recent report exceeded expectations with broad-based spending providing a sign that consumers are willing to spend.

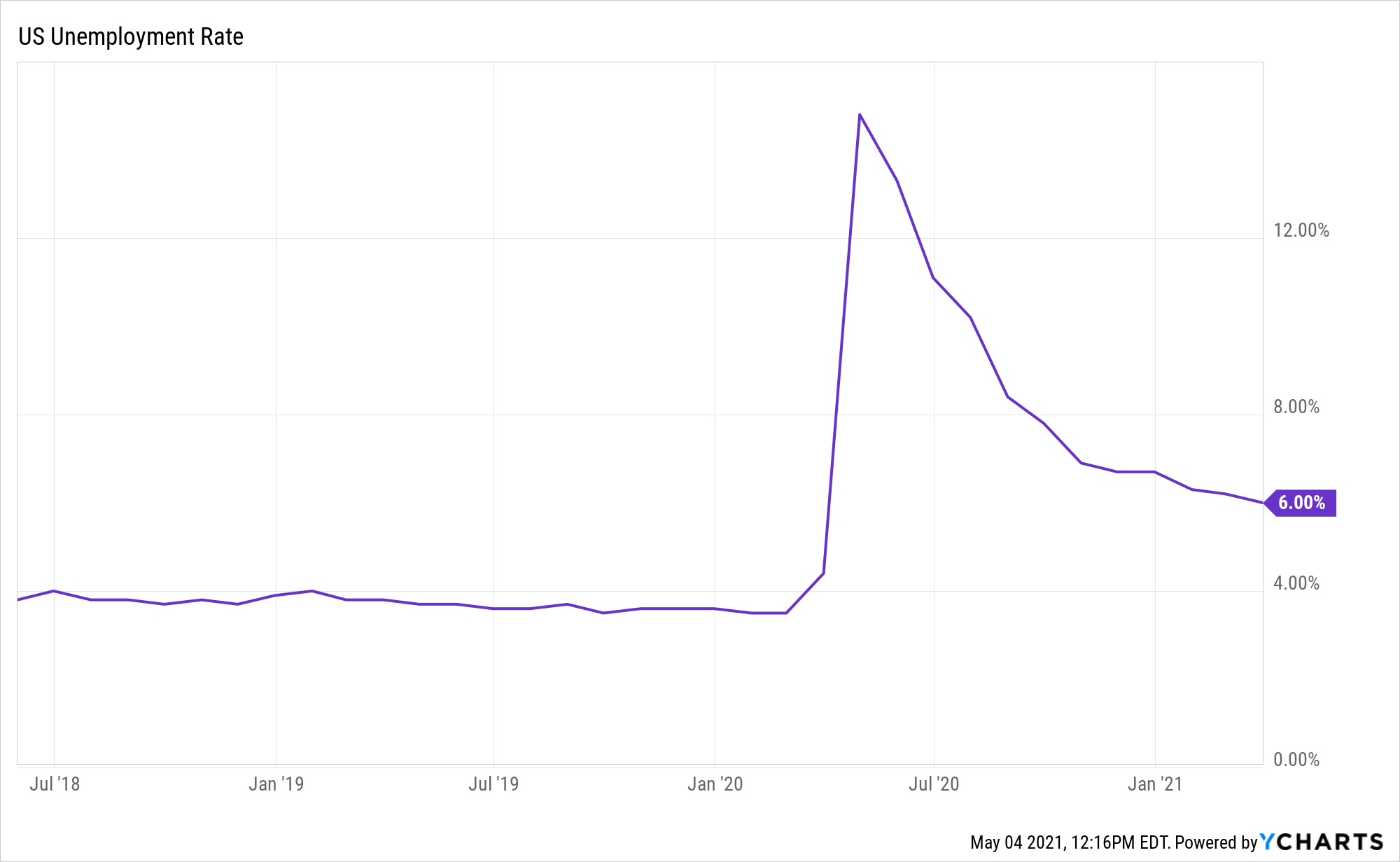

- Labor Market: while the labor market is not back to pre-pandemic levels, we have seen improvement recently. This is highlighted by a drop in the unemployment rate to 6% (YCharts).

- Both ISM Manufacturing and Services PMI business surveys surged to levels that haven’t been seen in 20+ years as these indicators point to strong economic growth in both the manufacturing and services sectors.

Amidst all of this good news, we continue to watch our economic dashboard closely for any sign of potential concern. One area that we’ve identified is market sentiment. We recently downgraded market sentiment on our dashboard as we see signs that investors are potentially feeling overly optimistic about the market. This contrarian indicator may be signaling an increased chance of volatility ahead.

While the sentiment indicator warns of potential near term volatility it can change very quickly. In fact, stock market volatility is common and we feel that at this time it would be a normal, and healthy, part of a bull-market. The rest of our economic dashboard continues to point toward economic growth and as such we have not made any major changes to portfolio positioning, but as always, we’ll be watching closely and will be ready to make changes as needed.

Sincerely,

Your Team at TLWM

*Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* No strategy ensures a profit or protects against a loss.