Monthly Market Update

Submitted by TLWM Financial on June 1st, 2021

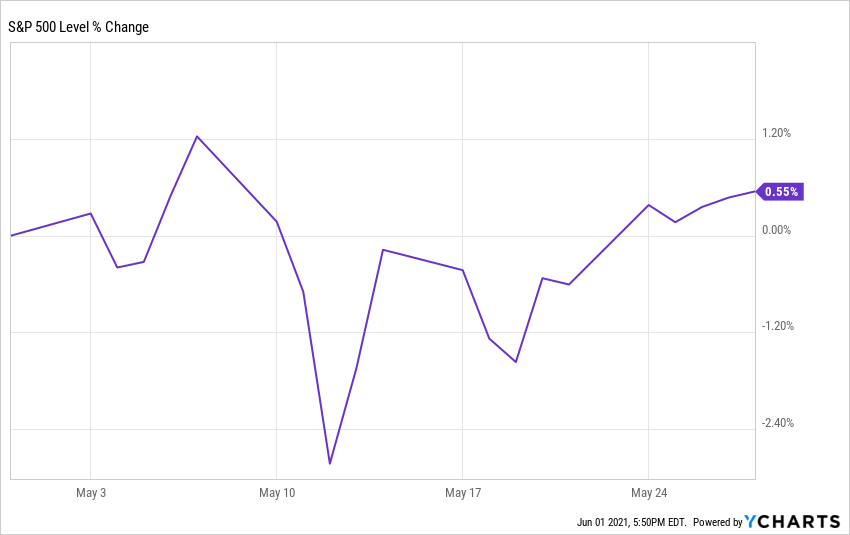

Last month we suggested that the chance for some stock market volatility had increased as our market sentiment indicator was flashing a warning sign. While May started out strong, we saw some volatility as the market pulled back in the middle of the month before bouncing back and finishing the month roughly where we started (YCharts).

The primary concern that grabbed headlines this month was inflation. This risk has become front and center as we continue to see a strong economic recovery, historic fiscal and monetary stimulus, and a much stronger than expected earnings season.

Inflation sounds scary – the potential for higher prices on everyday items leads us all as consumers to worry about whether we can continue to enjoy the same standard of living that we do today. That fear is understandable; however, we believe it’s important to clarify what type of inflation we are expecting to see.

We would break inflation into 3 broad categories: low inflation (in the 2% range), rising inflation (2-4%), and higher inflation (4%+). The first two kinds of inflation are not overly concerning, but certainly warrant watching. In fact, stocks (as an asset class) generally perform well in the first two categories. (Schwab) The question that we need to answer is whether or not we expect to see inflation overheat? While we are seeing some inflationary pressures, we feel it’s too early to declare that we’re seeing runaway inflation.

We are going to outline a few items that we will be watching and considering carefully as we monitor the inflationary environment.

- Base Effects: Inflation data is expected to be alarming over the next few months – don’t panic. Part of the reason for this is that the year-over-year data compares the current period to the sudden economic shutdown 1 year ago, likely resulting in some unusual numbers.

- Could Inflation be transitory? The Fed has suggested that this may be the case. In this scenario we would see inflation pressures recede as a number of temporary drivers (including recent supply chain problems) are resolved.

- Labor Market: The unemployment rate is still above 6% which could help keep wage pressures in check for the time being. This, combined with the lower labor force participation suggests that there is some slack in the labor market. This slack could help keep labor costs, a major source of inflation, down.

Rising rates and some inflationary pressures are not catching us off guard. Coming into this year we had already made some adjustments to the fixed income side of the portfolio. By reducing the duration (shorter maturity) of our bond portfolio we aimed to mitigate the impact of rising rates. So far, that has been beneficial.

We will continue to watch portfolios carefully, and will be ready to make changes to our positioning as the inflationary environment evolves.

Sincerely,

Your Team at TLWM

*Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* No strategy ensures a profit or protects against a loss.