Monthly Market Update

Submitted by TLWM Financial on September 1st, 2021

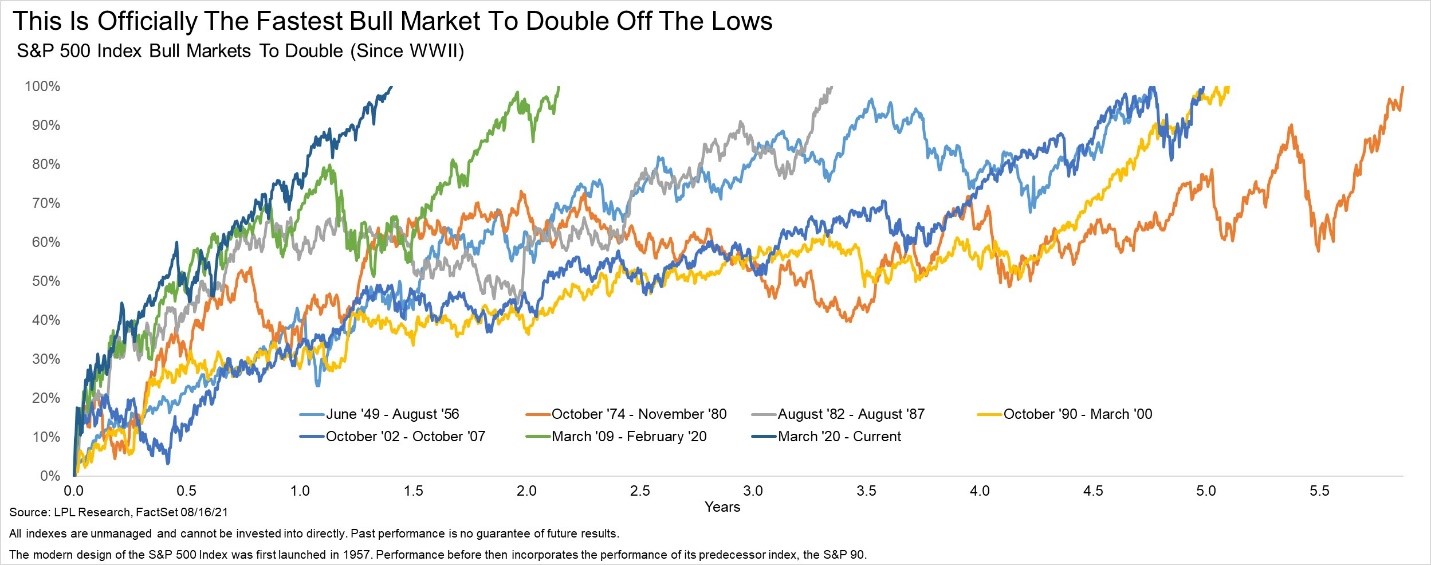

August was another steady month for stocks with the S&P 500 closing higher for the 7th month in a row and finishing up about 3%. (YCharts) The S&P 500 doubled from the Covid bottom in March of 2020, we consider this a major milestone as this is the fastest the S&P 500 has rallied 100% from the market lows since World War II. (LPL Financial)

While many investors have questioned the durability of this market rally, we believe that the sharp economic recovery, accommodative monetary and fiscal policy, and strong corporate earnings have justified this move higher.

One of the most significant catalysts for the market over the last 18 months has been support from the Federal Reserve. The Fed’s accommodative policies have provided a strong tailwind. Recent economic strength and inflationary pressures could lead the Fed to shift to a less supportive role. Changes in Fed policy could be a catalyst for some stock market volatility which we haven’t seen much of this year. We’ll be closely watching upcoming FOMC meetings for policy changes, with a particular eye on the following:

- Tapering: the Fed is currently buying $120 billion in bonds each month. We believe the recent economic improvement will cause the Fed to announce a plan to reduce, and eventually eliminate, these purchases in the months to come.

- Interest Rates: while slowing the pace of bond purchases is expected to be the first adjustment, the decision to raise interest rates is another key Fed tool. For now, the Fed isn’t expected to raise rates until late 2022 or 2023. (CME Fed Watch Tool)

While it’s likely the Fed will take its foot off the gas in the months and years to come, we would note that tapering is not tightening, and the Fed is likely to remain in an accommodative stance at this time. We continue to expect positive returns for stocks over the next 9-12 months as we see very few signs of a recession on the horizon; although, the potential for some volatility serves as a reminder that investors should ensure their asset allocation is in line with their long-term plan. We will continue to keep you updated on any changes to our outlook and will be ready to make changes to portfolios as needed.

Sincerely,

Your Team at TLWM

*Investment advice offered through TLWM, LLC., a registered investment advisor.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* No strategy ensures a profit or protects against a loss.