2018 TLWM Annual Outlook

Submitted by TLWM Financial on December 20th, 20172018 TLWM Annual Outlook:

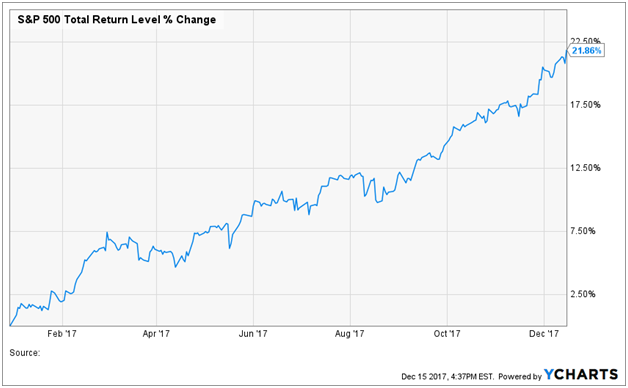

2017 has been a good year for most investors as stocks have rallied steadily throughout the year. The S&P 500 (total return) closed higher each month of the year, is now up almost 22% through mid December, and we haven't seen a 3% pull-back in that index during the year (LPL Research, YCharts). This year may be remembered as one of the steadiest and quietest stock market years we've ever seen. While stocks may have been quiet, the news cycle was anything but as President Trump and his administration took office, elections were held across Europe, tensions escalated with North Korea, natural events caused devastation, and bitcoin mania swept the nation. Amid that noise, strong economic fundamentals combined with robust corporate earnings growth set the stage for the strength that characterized the year.

We believe that some of the key reasons the US economy and stock market were strong in 2017 will continue to play a critical role in 2018 while there will surely be surprises lurking. The following commentary discusses many of the elements we feel could be significant in the year to come. Here are the highlights:

- We believe the US and global economy remain on firm footing and don't believe a recession is on the horizon.

- The US economy may see a boost from fiscal stimulus as the Trump administration seeks to push forward with tax reform, infrastructure spending, and regulatory change.

- Stock markets could see volatility pick up after an unusually quiet 2017.

- Growth in corporate earnings is poised to continue with or without tax reform.

- Geo-political risk around the globe could escalate, creating headline risk to economic and stock market growth.

- The Federal Reserve is expected to continue hiking rates in 2018. Rising interest rates could put pressure on fixed income, but we believe maintaining discipline in asset allocation is critical.

- Foreign markets potentially provide opportunity for investors given cheaper valuations and optimistic earnings expectations.

US Monetary and Fiscal Policy

The Federal Reserve has raised rates five times since December 2015 and has begun unwinding its balance sheet; however, they have done so slowly and appear to be normalizing policy while remaining supportive of economic growth. Most economists and Fed watchers think that another three hikes are likely during 2018. This includes the impact of the upcoming leadership shift as Jerome Powell is pending Senate approval to take over as the Fed Chair from Janet Yellen. Most investors view Powell's philosophical approach to monetary policy similar to that of his predecessor and don't anticipate any major shifts in the Fed's policy in the near term. We believe it's likely that the Fed will continue on a somewhat slow and steady path to higher rates, unless economic data (inflation and wage growth in particular) changes drastically.

The continuing shift in monetary policy may leave a void as investors wonder what will drive the economy forward. Into this void steps the federal government armed with the promise of fiscal stimulus. This stimulus is likely to come in the form of tax reform, infrastructure spending, regulatory reform, or some combination of the three. It should be noted that while each of these policies has the potential to provide a tailwind to markets, failure to push reforms through may disappoint investors and could lead to stock market volatility.

After failing to pass health care reform getting tax reform completed has become critical to Republicans and to President Trump's reputation. At this point it appears highly likely that some form of tax reform will get done. In our opinion, the key takeaway for investors is a lower corporate tax rate which should, in theory, leave US corporations flush with profits. How businesses spend those profits could determine how impactful and long-lasting the boost from the tax cut will be. Will companies invest in themselves or will they simply pass additional profits to investors through dividends and/or stock buy-backs? Both are likely bullish for stocks, at least in the near term; however, long-term business investment would likely have a longer lasting impact on the economy.

The other elements of fiscal stimulus are also important. We have already seen a major shift in regulatory environment for many industries as the regulatory burden has shrunk for many corporations. This can perhaps be seen most clearly in the financial sector where the regulatory pendulum swung sharply toward more regulation following the financial crisis, but now appears to be swinging back. Infrastructure spending could be a bit trickier. President Trump has repeatedly floated the idea of additional infrastructure spending, but with the focus on tax reform it remains to be seen how much political capital will be left to push forward on infrastructure spending.

Global Economic Strength

Additional fiscal stimulus is likely a net positive for the economy and stock market in 2018, but in our opinion we believe that the US and global economy remains on fairly strong footing even without major fiscal action. The best description of the strength of the global economy might come from the OECD (Organisation for Economic Co-operation and Development), as they show that all 45 economies they track are set to grow this year, with the majority of these showing growth that is accelerating (source: WSJ, OECD).

Earnings

Economic growth and strength is evidenced in many different ways, but at the end of the day investors want to know how much money corporations are making (their earnings). US earnings growth picked up during 2017, with three quarters already in the books, Factset estimates final S&P 500 earnings growth of 9.5% for 2017. This strength is projected to continue with earnings growth estimatesof 11.5% for 2018. Investors will continue to look to earnings growth next year as evidence of continued strength in the global economy.

Optimism toward earnings isn't limited to the US. Global earnings growth is also projected to continue after a very strong 2017 with projections for earnings growth in 2018 at 7.6% for developed foreign markets (MSCI EAFE), and 12.5% for emerging markets (MSCI Emerging Markets) {source: LPL Research, Factset}. Strength in earnings growth overseas, combined with attractive valuations compared to the US, leads us to believe that maintaining an allocation to foreign stocks is justified in 2018.

Economic Dashboard

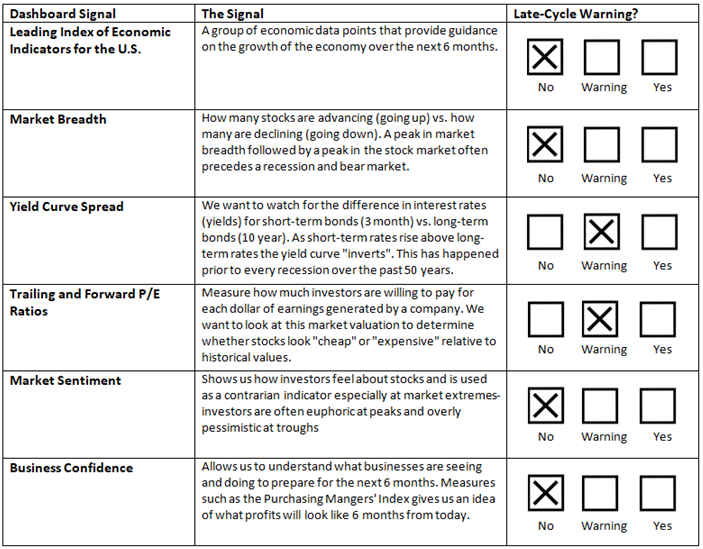

The fundamental strength we are seeing in the US economy and around the world is reinforced by our economic dashboard which continues to show strength in manufacturing, leading economic indicators, business confidence, and market breadth. This strength leads us to believe that a recession is unlikely over the next 9-12 months. When this is the case, we generally want to be fully invested in the growth side of the portfolio and remain so moving into 2018. While our dashboard leaves us optimistic for 2018, there are a couple of indicators that signal caution.

The first is stock market valuations. Using almost any measure, US stocks look more expensive than their long-term average. While this factor has historically led to below average stock market returns over the following decade, it doesn't help investors make decisions in the short term. We believe that given the historically low interest rate environment stocks continue to provide a good opportunity and may still look attractive to investors when compared to the prospects of investing in a 10 year US Treasury at a rate of 2.35% (as of 12.15).

The other cautious element of our dashboard is tied closely to the 10 Year Treasury yield and central banks. We watch the yield spread, the difference in yield between the 10 year Treasury and the 3 month Treasury Bill. It has historically signaled a recession over the next 12 months once the yield curve inverts (the 10 year yields less than the 3 month). We often see this when short-term rates move higher than long-term rates, which in many cases has occurred during times of tightening monetary policy. We are not close to inversion just yet, but given the economic and central bank backdrop this is an indicator we will watch closely in 2018.

Risks/Concerns

There is no doubt that we are optimistic moving into 2018, but as always there are a handful of risk factors we are watching closely, while also keeping our eyes open for surprises that may lurk around the corner, including:

- Political surprises, here in the US and abroad, with a close eye on Brexit negotiations and other global elections

- Geo-political conflict (particularly North Korea, and the Middle East)

- Central bank policy blunders-as global central banks look to begin normalization of monetary policy

- Rising interest rates in the US, and risk of the yield curve inverting

- Potential disappointment around any US fiscal policy failure

- Slower than expected economic growth

- Higher than average stock market valuations

Asset Allocation & Financial Planning

The TLWM outlook is that the risk of recession is low which means we want to be fully invested in our equity portfolios. We believe international stock markets show signs of solid economic and earnings growth while appearing attractive from a valuation perspective, thus we want to maintain both US and international exposure. On the other hand, the potential for rising interest rates in 2018 could mean a tougher year for fixed income/bonds as an increase in bond yields may cause bond values to drop.

Despite that forecast, we never advocate abandoning your recommended long-term asset allocation to chase higher returns. Fixed income can play a critical role in a portfolio and may be a key part of an appropriate asset allocation which becomes particularly evident during stock market volatility. We work carefully with each of our clients to determine an asset allocation that aims to maximize the chances of meeting goals and objectives while keeping in mind risk tolerance, time horizon, and income needs. Our financial planning process ensures that we leave no stone unturned and determine a purpose for every dollar.

As in any year we expect to see the unexpected and remain ready to monitor and tweak our portfolio allocation as needed.

We wish all of you a happy and healthy year ahead.

Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through TLWM, LLC., a registered investment advisor and separate entity from LPL Financial.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* Stock investing involves risk including loss of principal.

* The price-earnings ratio (P/E Ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

* This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Texas Legacy Wealth Management and its representatives are properly licensed or exempt from licensure.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

*Credit risk can be a factor in situations where an investment’s performance relies on a borrower’s repayment of borrowed funds. With credit risk, an investor can experience a loss or unfavorable performance if a borrower does not repay the borrowed funds as expected or required. Investment holdings that involve forms of indebtedness (i.e. borrowed funds) are subject to credit risk.

* Typically, the values of fixed-income securities change inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that their value will generally decline as prevailing interest rates rise, which may cause your account value to likewise decrease, and vice versa. How specific fixed income securities may react to changes in interest rates will depend on the specific characteristics of each security. Fixed-income securities are also subject to credit risk, prepayment risk, valuation risk, and liquidity risk. Credit risk is the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of a bond to decline.