TLWM Financial Outlook 2023

Submitted by TLWM Financial on December 22nd, 2022

As 2022 comes to a close we look back on an eventful and challenging year for investors as the economy and stock market faced a number of headwinds which led to a bear market for stocks, and negative returns for fixed income. Those headwinds were led by stubbornly high inflation, a big jump in interest rates, and concerns that we are heading toward a recession. In this outlook we will discuss these factors along with other key areas to watch in 2023.

Inflation:

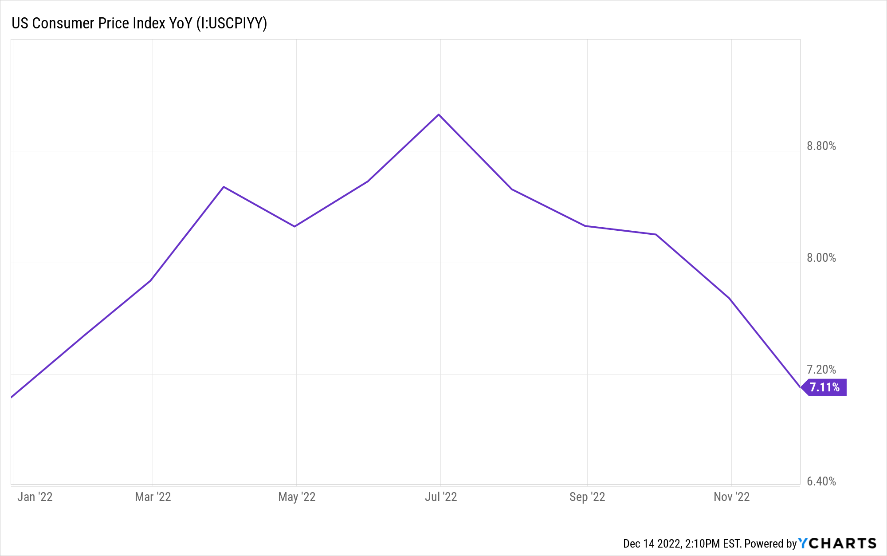

Inflation was likely the most discussed, economic data point of the year. As the year began many investors hoped that inflationary pressures would fade quickly as supply chain issues were resolved. That didn’t happen as inflation continued to heat up throughout the first half of the year. The last few months of data show that inflation may have peaked. While we have a long way to go, an improving inflation environment would be welcomed by investors.

Monetary Policy & Interest Rates:

The Federal Reserve has been clear that they are taking their fight on inflation seriously. The Fed’s resolve has been evidenced by aggressive rate hikes and restrictive monetary policy. In simple terms, the Fed wants to slow down the economy in order to reduce inflation. The big question is whether this approach will lead to a recession.

As such, many investors are hoping for a “Fed pivot”. A pivot would mean a shift to a less restrictive monetary policy. This would be seen by many as an encouraging sign because the end of a rate-hike cycle usually leads to positive equity returns. For a pivot to become a reality we likely need to see inflation data improve a lot. If that happens, it’s possible that Fed policy turns from a headwind to a tailwind at some point in 2023.

The Economy:

Our economic dashboard guides our outlook for economic growth. Currently, our dashboard signals an elevated chance of recession in 2023 with a number of signals flashing “red”. While a recession is not a foregone conclusion there are signs that economic growth is likely to be sluggish throughout the year.

Despite these concerns we continue to see a strong labor market and healthy consumer as positive factors for economic growth. While we could see these data points deteriorate, they have been steady throughout the year highlighted by a low unemployment rate. While good for job seekers the strong labor market presents challenges for businesses and presents inflationary pressures as wage growth has been strong.

Corporate Earnings:

Thus far, businesses have weathered the storm in 2022 and corporate earnings are on track to record single digit earnings growth. (FactSet) The big question for 2023 is whether corporations can continue to navigate the challenging economic environment. This likely comes down to whether or not we enter a recession, and if we do, how deep that recession ends up being. According to FactSet, analysts expect earnings growth in the mid-single digit range next year. If corporations can deliver on those expectations, then that will likely be helpful for stocks.

Other Surprises:

There are almost always surprises that move markets. An example of this in 2022 was Russia’s invasion of Ukraine and the subsequent (and ongoing) conflict. Whether surprises in 2023 are geo-political, political, or economic in nature we’re likely to feel the impact of some unanticipated events.

Portfolio Positioning:

Currently we have a cautious outlook and, as such, a portion of our growth portfolio is positioned defensively given the elevated risk of recession shown by our dashboard. This has been the case throughout much of 2022 and that positioning has been beneficial. Moving forward, we are actively looking for opportunities to get that dry powder back to work. These opportunities could present themselves as economic data improves or a market selloff could give us an opportunity to buy low. Our investment team will continue to keep a close eye on market conditions and will be ready to make changes as conditions evolve.

Fixed income performance was also negative this year as rising interest rates led to a decrease in value for most bonds. Our investment philosophy is to have a maturity date on the fixed income we hold in portfolios. A major benefit of this strategy is the ability to take advantage of opportunities in a rising interest rate environment. Our laddered strategy means that as bonds mature, we can reinvest in bonds with higher yields. This is something we recently took advantage of in most portfolios.

Financial Planning & Asset Allocation:

While our investment team determines how to position portfolios, our financial planning team looks at the big picture by determining an appropriate overall asset allocation. Each client that we work with has access to our team of Certified Financial Planners (CFP’s). Last year that team answered many planning related questions and made planning recommendations with the goal of maximizing your chances of success. By leaving no stone unturned in our planning process we seek to determine a purpose for every dollar. If you have any friends, colleagues, or family that you feel could benefit from this approach please feel free to forward along this outlook to them and let us know – we’d be happy to reach out.

We are thankful for the privilege to work with each of you and look forward to a great 2023! We hope you and your family have a healthy and happy holiday season!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can

be no guarantee that strategies promoted will be successful.