TLWM Financial Outlook 2024

Submitted by TLWM Financial on January 9th, 2024

2024 TLWM Annual Outlook

2023 has been a profitable year for most investors with strong gains in stocks after a challenging 2022. Despite a number of headline risks throughout the year, including a banking crisis and escalating geo-political conflicts, the most meaningful drivers were economic growth, inflation, and Federal Reserve policy.

During the year economic growth continued to beat expectations as inflation cooled, while the Fed pursued restrictive policy by raising rates. As we look to 2024, we believe it could be a year of normalization as data in a number of areas may continue to revert to more normal, long-term levels. The key questions for 2024 include: what will happen to inflation, what will economic growth look like and will we avoid a recession?

Currently, our base case is that the economy avoids a meaningful recession, corporate earnings remain resilient, and stocks move moderately higher. Of course, our active approach means that as economic data evolves, we’ll be ready to make adjustments to our portfolio positioning which we outline in more detail below.

With that in mind, here’s our thoughts on the factors to watch in 2024.

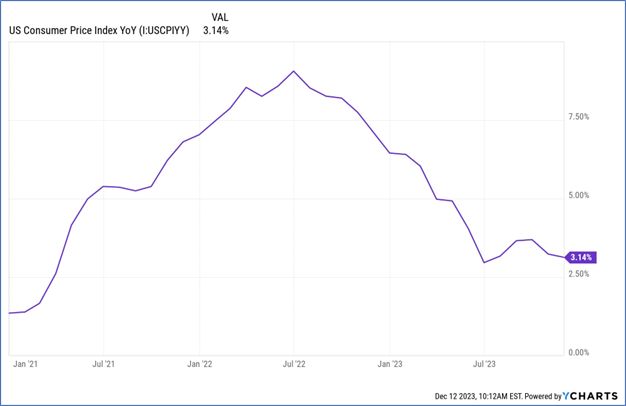

Inflation

While we all still feel the impact of higher prices there is no doubt that inflationary pressures overall have been easing. This is positive as high inflation leads to headwinds, including restrictive economic policy, and a challenging environment for the consumer. The most recent CPI reading was 3.14%, a huge improvement from the peak of 9.06% in June 2022, but still above the Fed’s long-term goal of 2%. Moving forward, we believe it’s important that this trend continues. (YCharts)

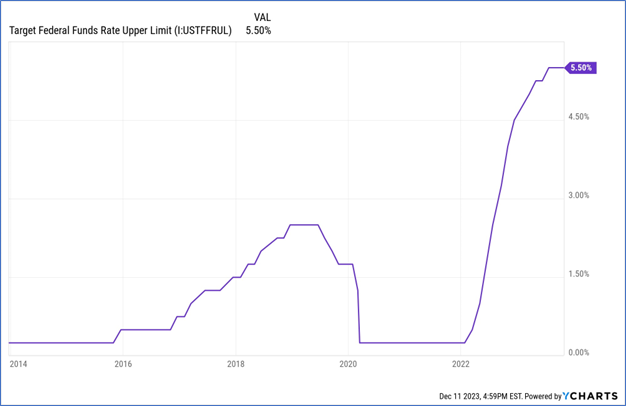

Monetary Policy – The Fed

Federal Reserve policy is a big driver for the economy as the Fed’s dual mandate means they keep a close eye on both inflation and employment – at times pushing the economy forward, and at others trying to apply the brakes. For the bulk of last year, the Fed was focused on fighting elevated inflation by raising interest rates (slowing the economy down). Given steady progress in fighting inflation the Fed has kept rates steady since July, and most investors believe that we have seen the last hike of this cycle, and cuts are likely next year. This could be good news for investors as Fed policy may be turning from a headwind into a tailwind.

Recent economic data has been goldilocks in nature: weak enough to reinforce the idea that Fed tightening is ending, but not so weak to signal that a recession is imminent. One risk that we’ll be watching is the lagged impact of last year’s hikes on the economy. Will this lead to a further economic slowdown? While we are likely to see rate cuts next year, we don’t want cuts to be coming due to a sharp recession.

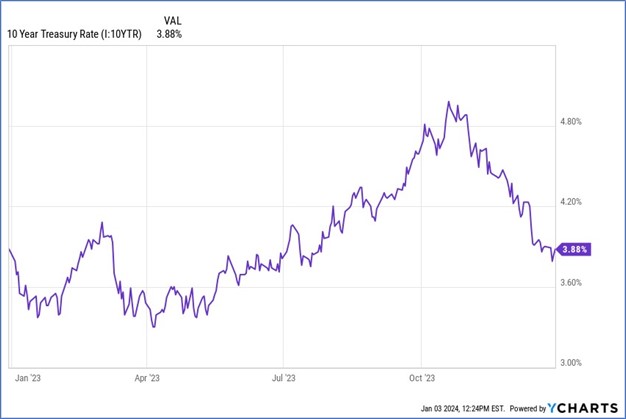

Interest Rates

Inflation and Fed Policy drive interest rates. Over the course of the last few years, we’ve seen a significant jump in rates that has led to higher borrowing costs for both corporations and consumers. Perhaps the clearest example of this has been the jump in mortgage rates – the 30-year fixed mortgage rate got close to 8% earlier this year, before backing off over the last few months. Rates have moved lower as inflation has improved and the Fed has hinted that they are done hiking rates. Lower rates could be a potential tailwind for the economy, stocks, and could also boost price returns on the fixed income side of the portfolio.

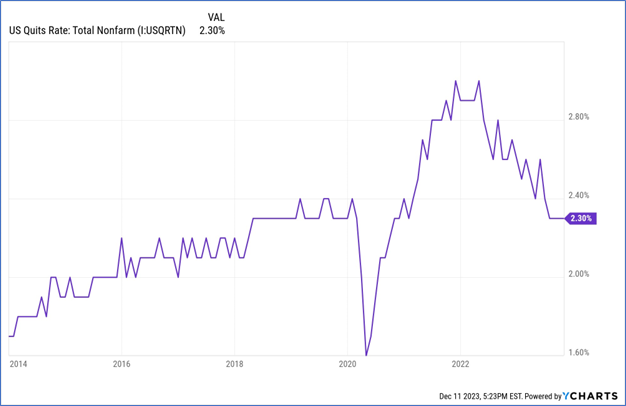

Labor Market

One reason we’re optimistic about the economy is the ongoing strength in the labor market. The unemployment rate is a very low 3.7%, and the economy added jobs every month this year. That said, the labor market appears to be normalizing – as less employees are voluntarily quitting, and we’re adding a steadier number of jobs each month. A normalization from a very tight labor market is healthy, and likely to be a positive when it comes to inflationary pressure.

The Consumer

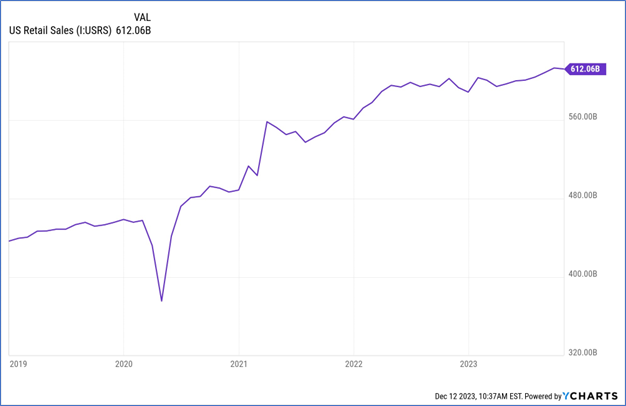

A strong consumer has helped drive the economy in 2023, as consumer spending makes up approximately 70% of US GDP. How the consumer holds up in 2024 is likely to be important not only for the economy, but also for corporate earnings and stocks. We believe that a strong labor market combined with improving inflation is a good backdrop for consumers. That said, we are watching closely for signs that the consumer is slowing. Most notably, we’ve seen potential cracks for consumers as credit card debt has jumped, delinquency rates (autos and credit cards) have started to pick up, and borrowing costs are higher. The good news is that these increases are from historically low levels, and aren’t concerning to us yet…but we’ll be watching.

Corporate Earnings & Valuations

Corporate earnings stalled out a little in the first half of ’23, but picked up in the third quarter and are projected to be stronger for Q4 and into 2024. Analysts are projecting earnings growth of 11.8% for 2024 (FactSet) with earnings accelerating throughout the year. We believe that it’s important to see steady earnings growth as stocks don’t currently look cheap, and may need continued earnings growth to move higher next year.

Political & Geo-political Factors

2024 is a presidential election year in the US and the election will undoubtedly dominate the headlines as we get closer to November. We watch political drivers closely, and will be on the lookout for any economic impacts as the election nears. In addition to the US election, other wildcards may be found in geo-political events and tensions across the world. It’s possible that surprises emerge. Uncertainty can create volatility in markets, but quite often markets resume their prior trend after having some time to digest the latest news.

Portfolio Positioning

Our current outlook is for economic growth to continue, albeit at a potentially slower pace given the ongoing impact of recent Fed Policy and how that policy may affect consumers and businesses. That said, we don’t currently think that a recession is imminent and remain fully invested on the growth side of our portfolio.

Our investment philosophy calls for an active approach, as we seek to shift to a more defensive allocation if we feel economic data and our dashboard suggest it’s necessary. Most recently, we moved a significant portion of our growth portfolio to the sidelines in 2022 as stocks went through a bear market. We re-allocated that defensive allocation late in ’22 and early in ’23 which allowed our clients to participate in the strong returns in ’23.

We are not only active in our growth portion of the portfolio, but also in fixed income. Our approach of having fixed income with maturity dates and laddering bonds has allowed us to take advantage of rising rates, by reinvesting in bonds with higher yields as bonds mature. We recently took advantage of this in most portfolios.

Financial Planning & Asset Allocation

While our investment team determines how to position portfolios, our financial planning team looks at the big picture by determining an appropriate overall asset allocation. Each client that we work with has access to our team of Certified Financial Planners (CFP’s ®). In 2023, the team made many planning recommendations for clients with the goal of maximizing your chances of success. By leaving no stone unturned in our planning process we seek to determine a purpose for every dollar. If you have any friends, colleagues, or family that you feel could benefit from this approach please feel free to forward along this outlook to them and let us know – we’d be happy to reach out.

We are thankful for the privilege to work with each of you and look forward to a great 2024!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can

be no guarantee that strategies promoted will be successful.