Market Updates

TLWM Market Updates

Monthly Market Update

Submitted by TLWM Financial on March 1st, 2024

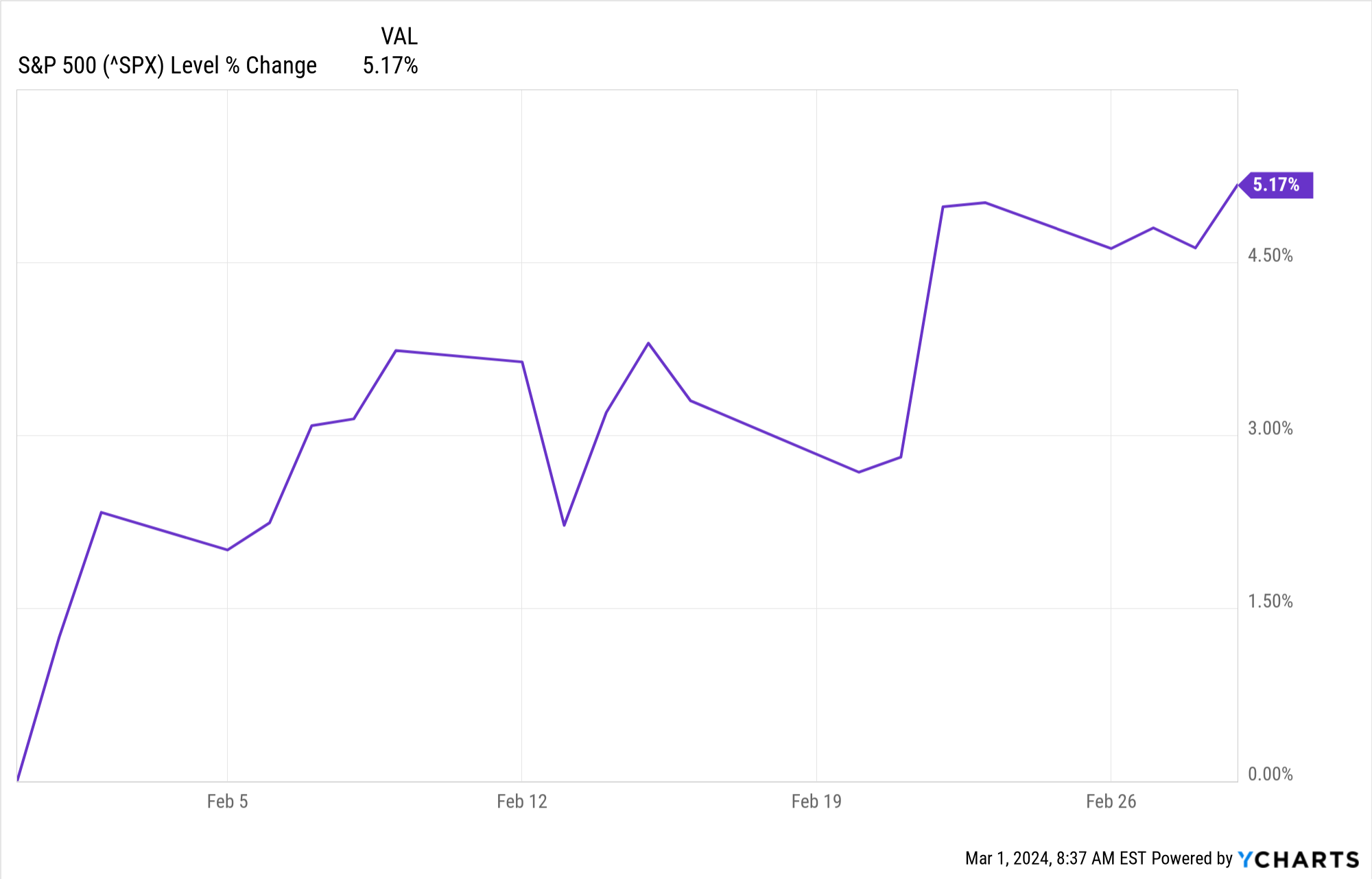

February was another great month for stocks, as markets once again hit new all-time highs. The S&P 500 finished February up about 5.2%, bringing the year to date returns for the index to almost 7% - a very strong start to the year. (YCharts)

Last month we pointed out a couple areas we’d be watching closely and sure enough these were big news makers for markets in February as we got some surprises from economic data, while strong corporate earnings helped drive positive returns.

Today, we’re going to give a quick update on three important (and connected) areas that have evolved over the course of the month:

Monthly Market Update

Submitted by TLWM Financial on February 1st, 2024

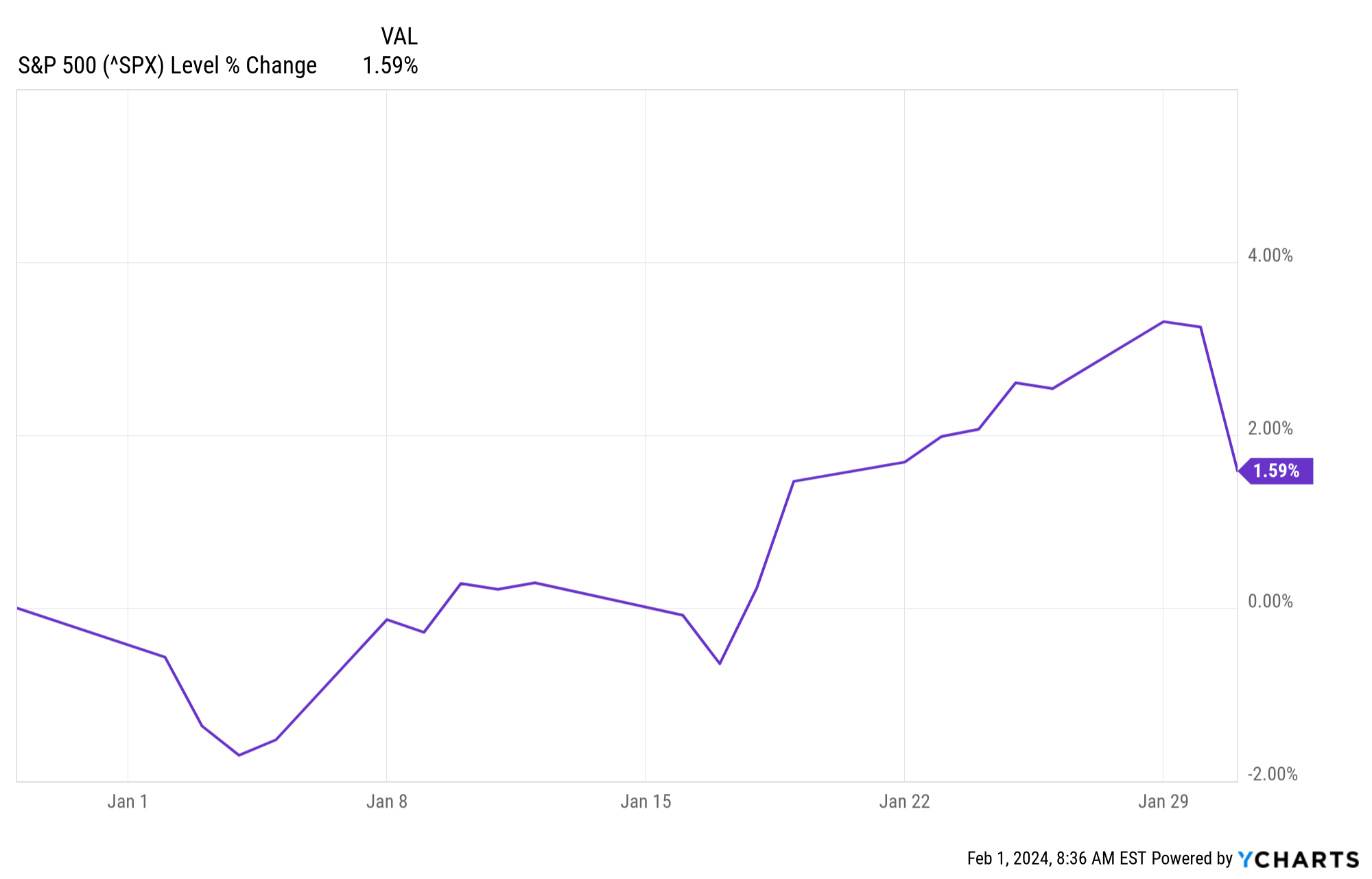

The year started just as we finished 2023 with stocks rallying, hitting new all-time highs for the first time in over two years. The S&P 500 finished January up about 1.6%, while bond yields drifted slightly higher with the 10 Year US Treasury yield closing the month at 3.99%. (YCharts)

Positive returns over the last few months have been welcome, but we’re always on the look out for risks and thought we’d highlight a few areas that we’re currently watching closely:

HSA vs FSA: A Breakdown

Submitted by TLWM Financial on January 30th, 2024

Depending on your current health insurance plan, you may have access to either a flexible spending account (FSA) or a health savings account (HSA).

Both are tax-advantaged accounts that can help individuals and families save money for qualified medical expenses. However, there are several key differences between the two—here’s a closer look at what you need to know.

Unused 529 Plan Funds: 5 Spending Options to Consider

Submitted by TLWM Financial on January 30th, 2024.png)

529 plans are tax-advantaged savings vehicles designed to accumulate contributions and help pay for the beneficiary's qualifying education expenses. Sometimes, 529 plans have unused funds after the beneficiary graduates or decide to discontinue their education. There may be other reasons the funds were not used, such as:

A Quick Guide to Estate Planning for Those With High Net Worth

Submitted by TLWM Financial on January 30th, 2024

Even if you never thought of yourself as especially wealthy, there may be a fair chance that you fall into the category of "high net worth individuals"—those who have liquid assets of $1 million or more1. For many individuals who hope to leave a legacy for their loved ones, estate planning may take on new importance.

Giving Through a Donor Advised Fund: 5 Tax Benefits

Submitted by TLWM Financial on January 30th, 2024

A donor-advised fund (DAF) is a charitable giving vehicle administered by a public charity created to manage charitable donations on behalf of organizations, families, or individuals. The benefits of DAFs extend beyond their primary purpose of facilitating philanthropic activities. One of the main incentives of DAFs is the tax benefits donors receive from giving.

IRS Announces New 2024 Income Tax Brackets

Submitted by TLWM Financial on January 30th, 2024Financial Planning for Private Business Owners

Submitted by TLWM Financial on January 23rd, 2024A necessity that underpins stability and growth for your business and you.

Financial planning is a critical element for the success of any private business owner. It provides a roadmap for working toward both short-term and long-term goals and can help improve the financial health of the business.