Market Updates

TLWM Market Updates

Monthly Market Update

Submitted by TLWM Financial on December 1st, 2023

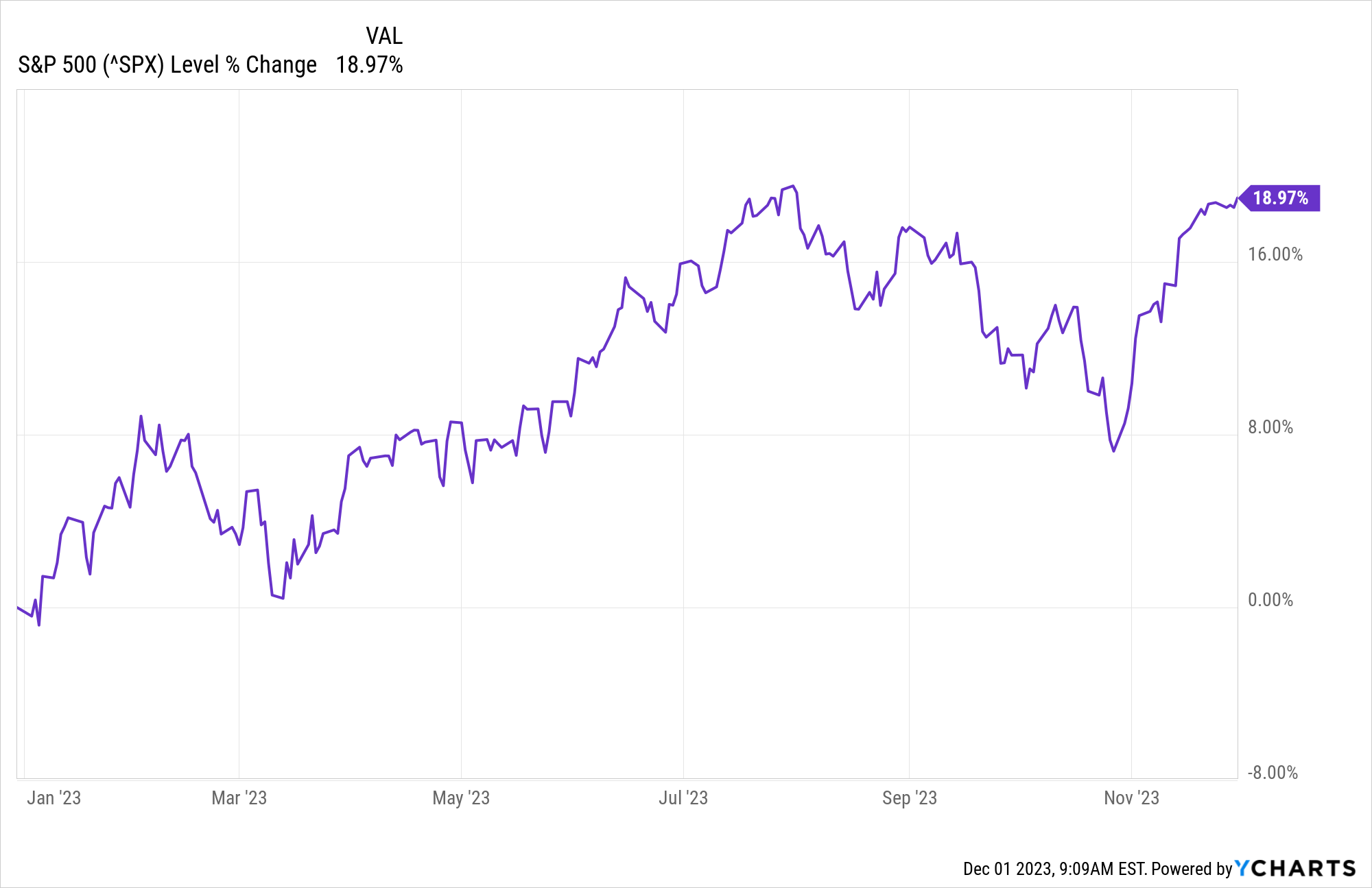

We hope everyone enjoyed their Thanksgiving and the rally we saw in stocks last month!

The S&P 500 bounced back in November, up roughly 9% for the month. This move higher was welcomed, particularly as it followed a 10% pull-back from the July highs. Bonds also rallied as the 10-YR treasury yield dropped, closing at 4.37%. (YCharts)

Over the course of the month, there were 3 main themes that likely contributed to the move higher.

ENZO T. PELLEGRINO, CFP® Awarded 2023 Non-Profit and Corporate Philanthropy Winner

Submitted by TLWM Financial on November 21st, 2023

3 Steps to a High-Net Worth Retirement

Submitted by TLWM Financial on November 7th, 2023Saving for a high-net-worth retirement is not always an easy process, but necessary if an investor with a high-net-worth wishes to enjoy the same lifestyle they were accustomed to while they were working. So how does one maintain their wealth so that they might live the life they desire once they hit retirement age? A few simple steps may help make the process a little easier.

The Philanthropic Mindset: How to Give Well and Wisely

Submitted by TLWM Financial on November 7th, 2023Having a desire to give and a philanthropic mindset are both important qualities to possess in modern society. With so many economic and social challenges in society, contributions to charities and philanthropy efforts are needed now more than ever. While you likely may appreciate the value of giving, you also want to give wisely.

401(k) Rollovers Can Make or Break Retirement

Submitted by TLWM Financial on November 7th, 2023Making informed decisions about retirement is crucial to financial independence

In an era characterized by high job turnover, it is more important than ever for employees to carefully manage their retirement savings.

4 Practices to Avoid in Tax Aware Investing

Submitted by TLWM Financial on November 7th, 2023Tax aware investing focuses on optimizing your returns by reducing your tax liability as much as possible. In theory, this investment strategy has the potential to help you earn more money on your investments, but you need to be aware of some potential pitfalls. When getting started with tax aware investing, you may want to avoid the following practices.

Elder Care, Caregivers, and Estate Planning: What You Need to Know

Submitted by TLWM Financial on November 7th, 2023If you or a loved one are approaching the point of needing elder care, you may be wondering what your options are. What level of care is right for your situation? How will you pay for care? What will happen when you need a more intensive level of care? Here we discuss some of the most important estate planning factors for elders and their caregivers.

Monthly Market Update

Submitted by TLWM Financial on November 1st, 2023

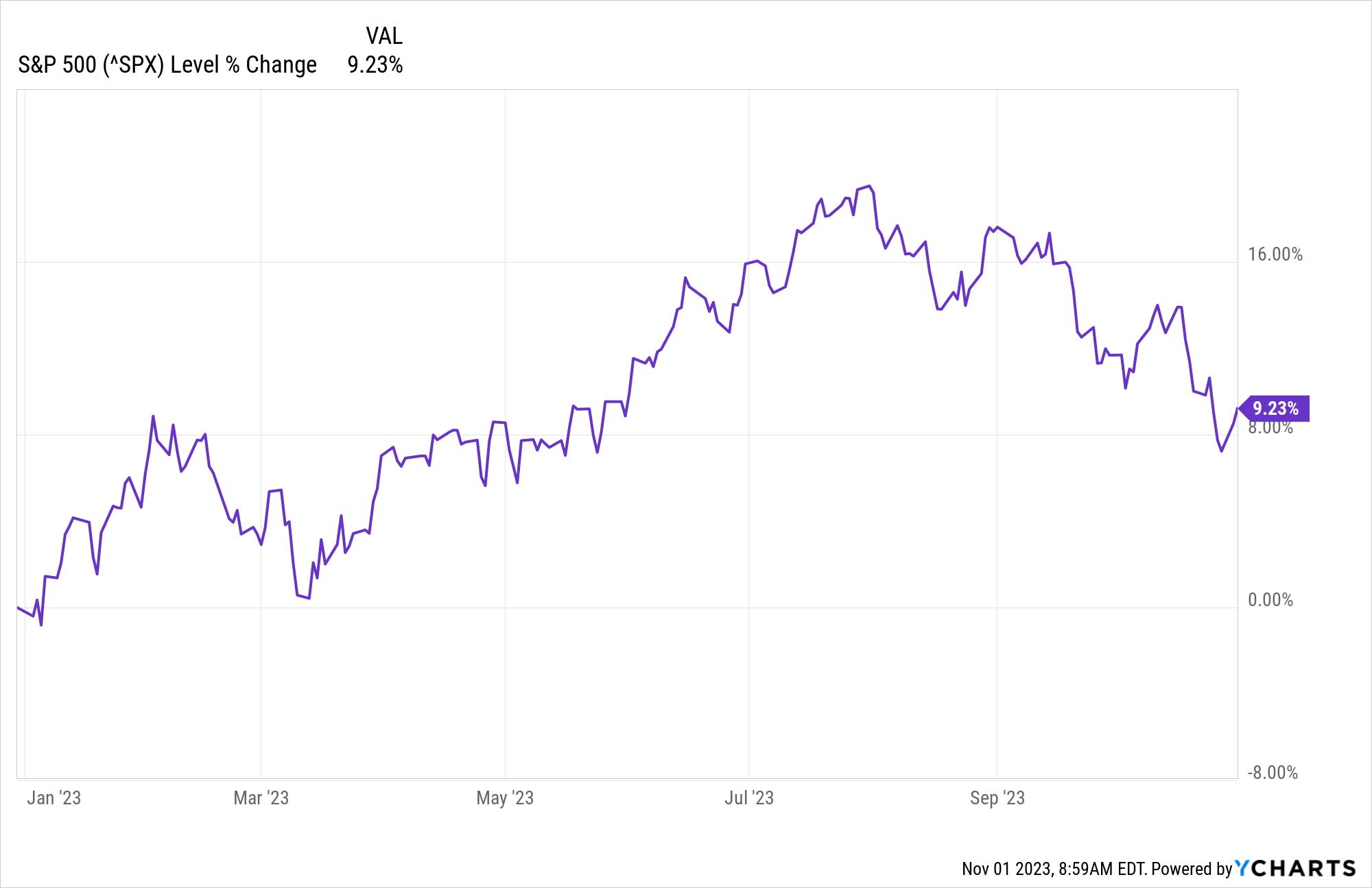

October was a challenging month for stocks as the S&P 500 ended the month down about 2%, leaving stocks up roughly 9% for the year. Bonds also faced some headwinds as the 10 Year Treasury Yield rallied, crossing 5% for the first time since 2007. (YCharts)

Understandably, we’ve had a lot of questions about the recent volatility. Today we will address 3 of the most common topics:

- Interest Rates – Interest rates have jumped significantly this year, but the economy has managed to digest higher rates with GDP growth hitting 4.9% in the 3rd quarter. The future direction of rates is important as significantly higher rates could put pressure on economic growth and stocks. Inflation, Fed policy, and economic strength are three factors that we’ll be watching closely.

Elder Care, Caregivers, and Estate Planning: What You Need to Know

Submitted by TLWM Financial on November 1st, 2023

If you or a loved one are approaching the point of needing elder care, you may be wondering what your options are. What level of care is right for your situation? How will you pay for care? What will happen when you need a more intensive level of care? Here we discuss some of the most important estate planning factors for elders and their caregivers.