Monthly Market Update

Submitted by TLWM Financial on February 1st, 2024

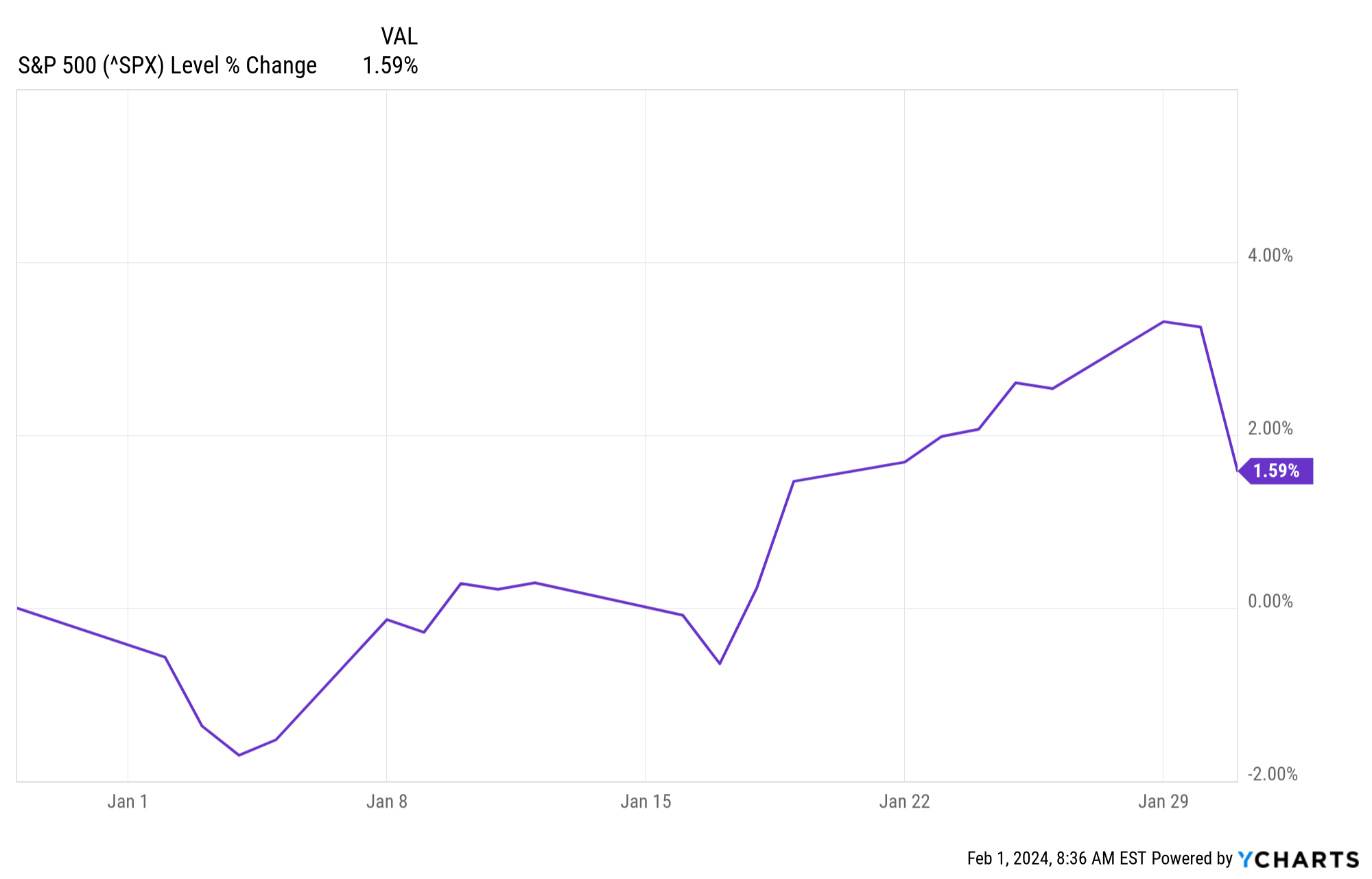

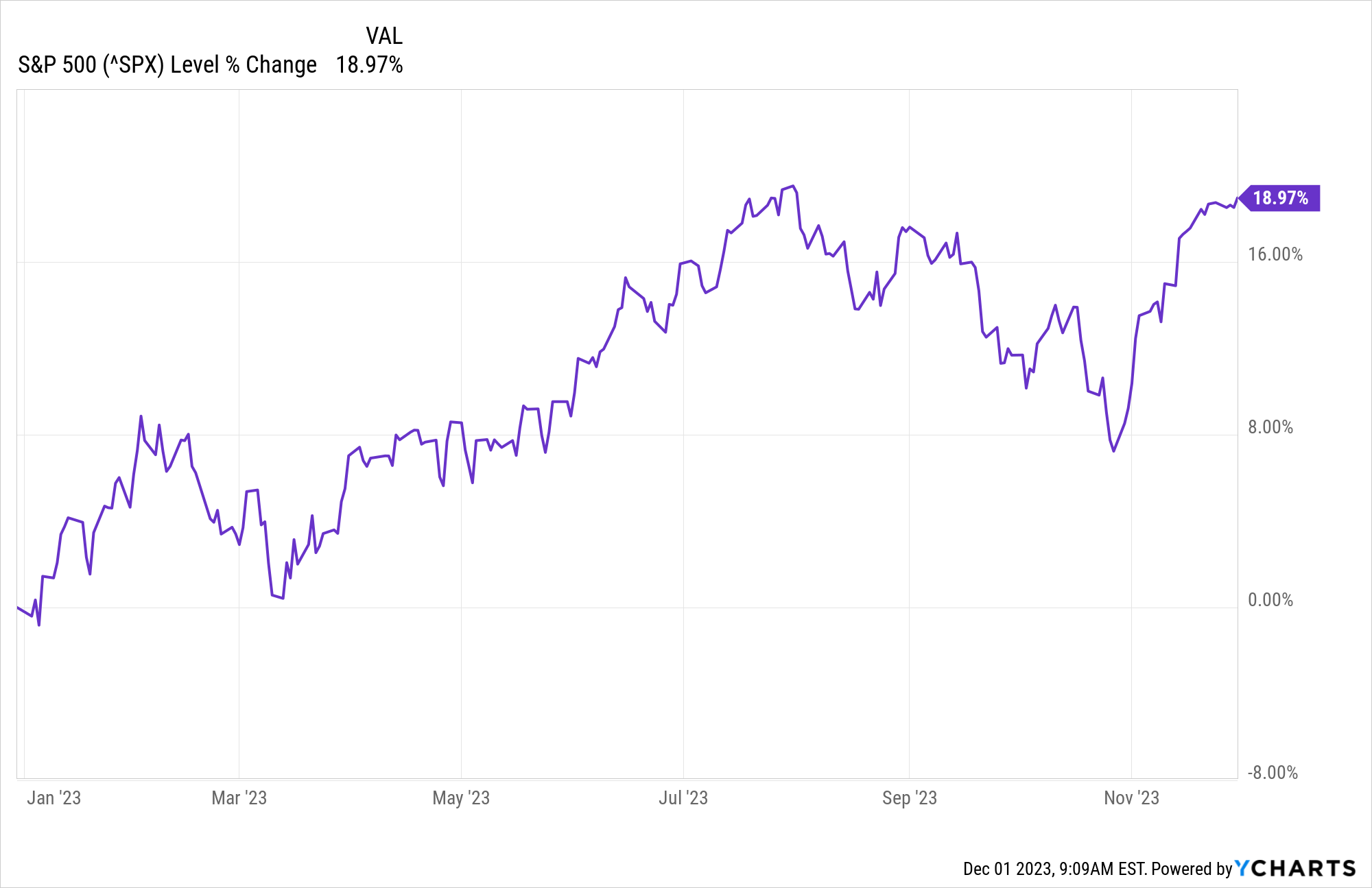

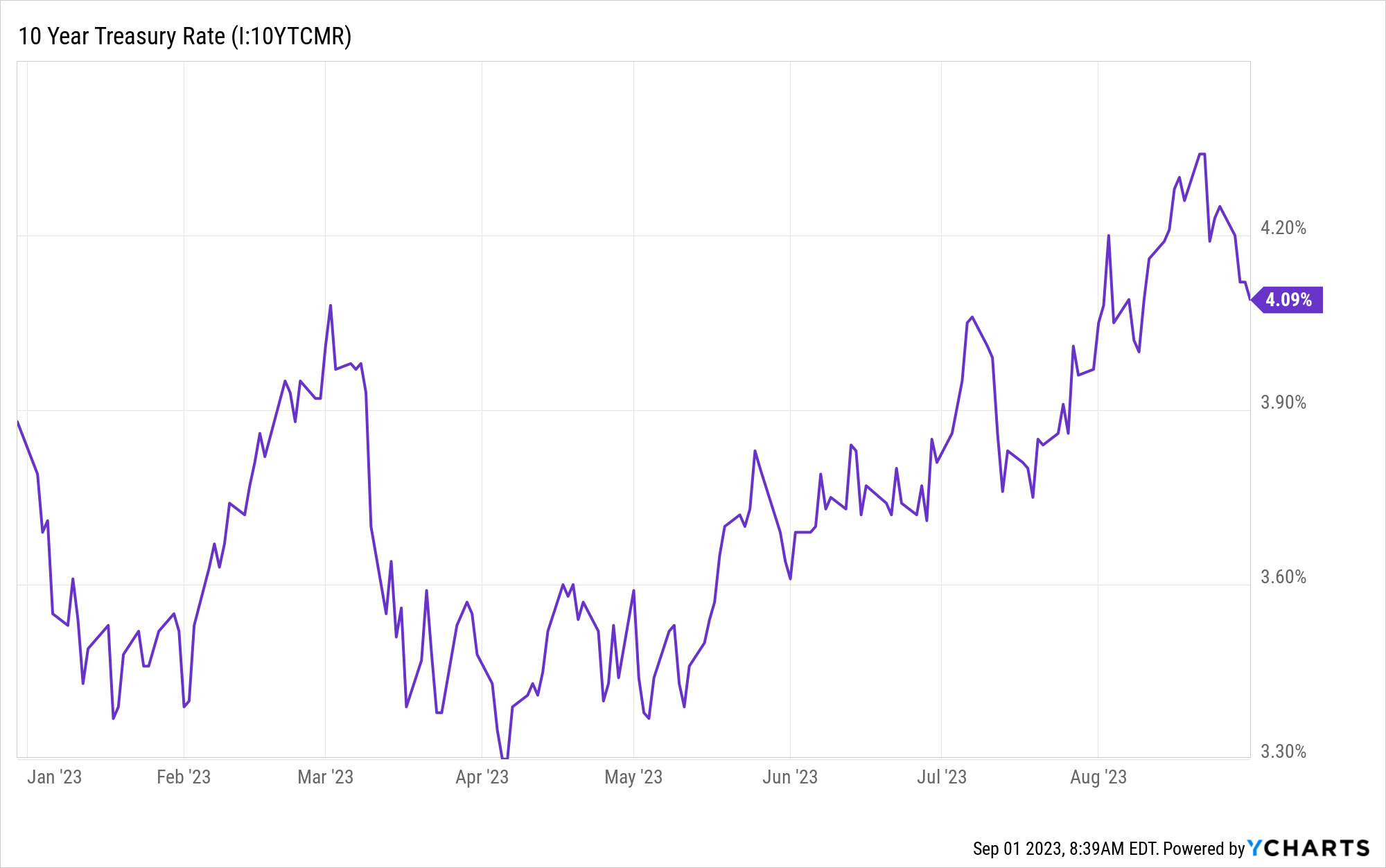

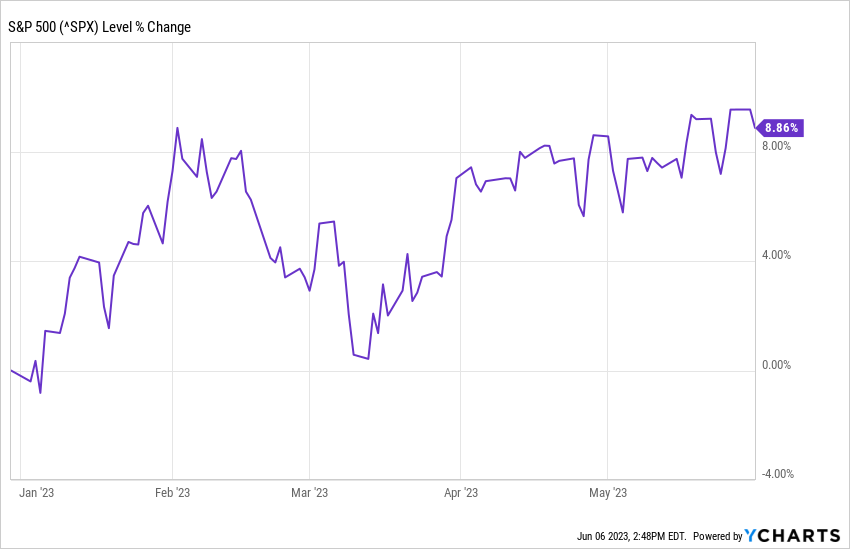

The year started just as we finished 2023 with stocks rallying, hitting new all-time highs for the first time in over two years. The S&P 500 finished January up about 1.6%, while bond yields drifted slightly higher with the 10 Year US Treasury yield closing the month at 3.99%. (YCharts)

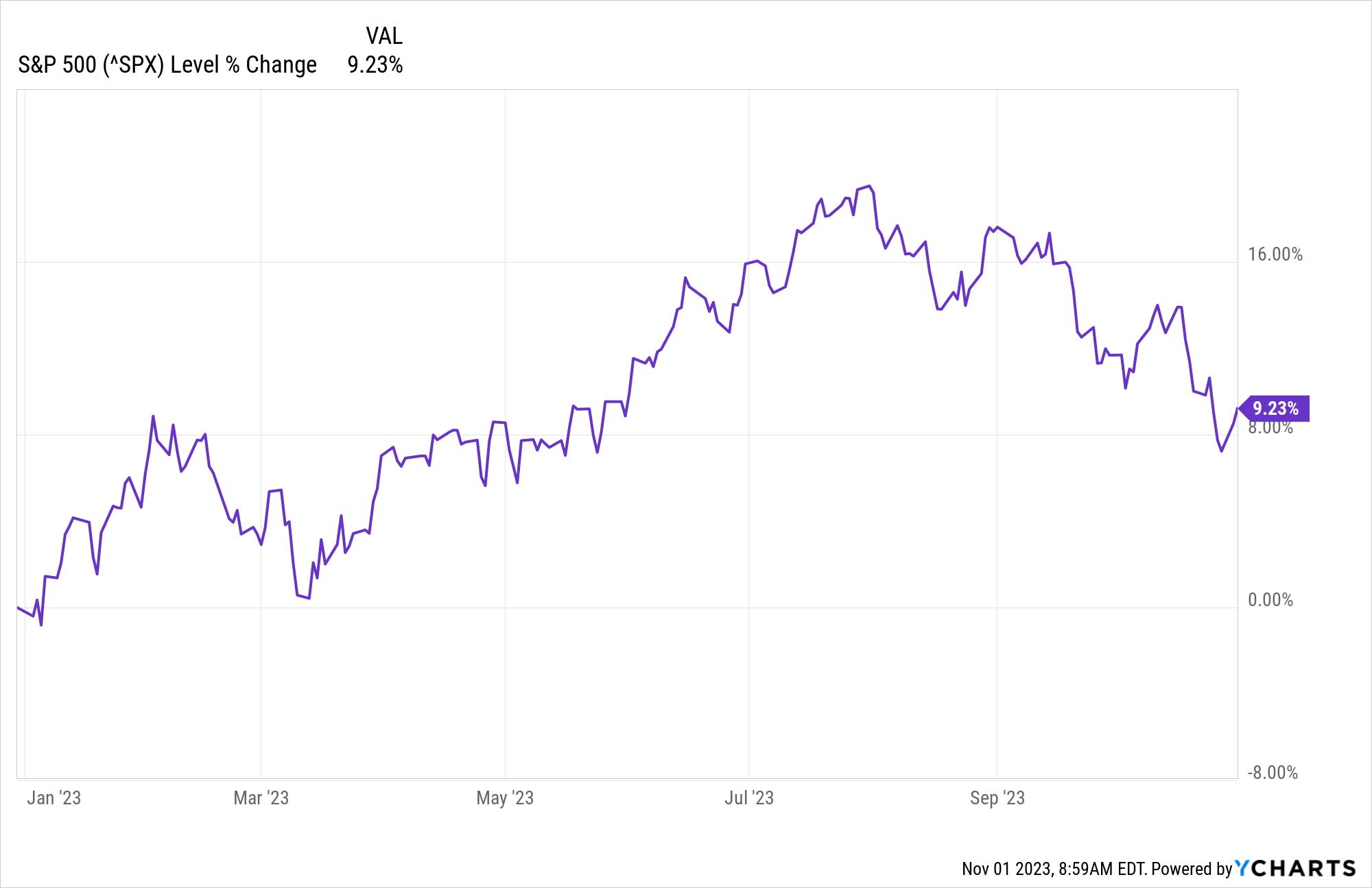

Positive returns over the last few months have been welcome, but we’re always on the look out for risks and thought we’d highlight a few areas that we’re currently watching closely:

- April 2023.png)