Monthly Market Update

Submitted by TLWM Financial on April 3rd, 2023

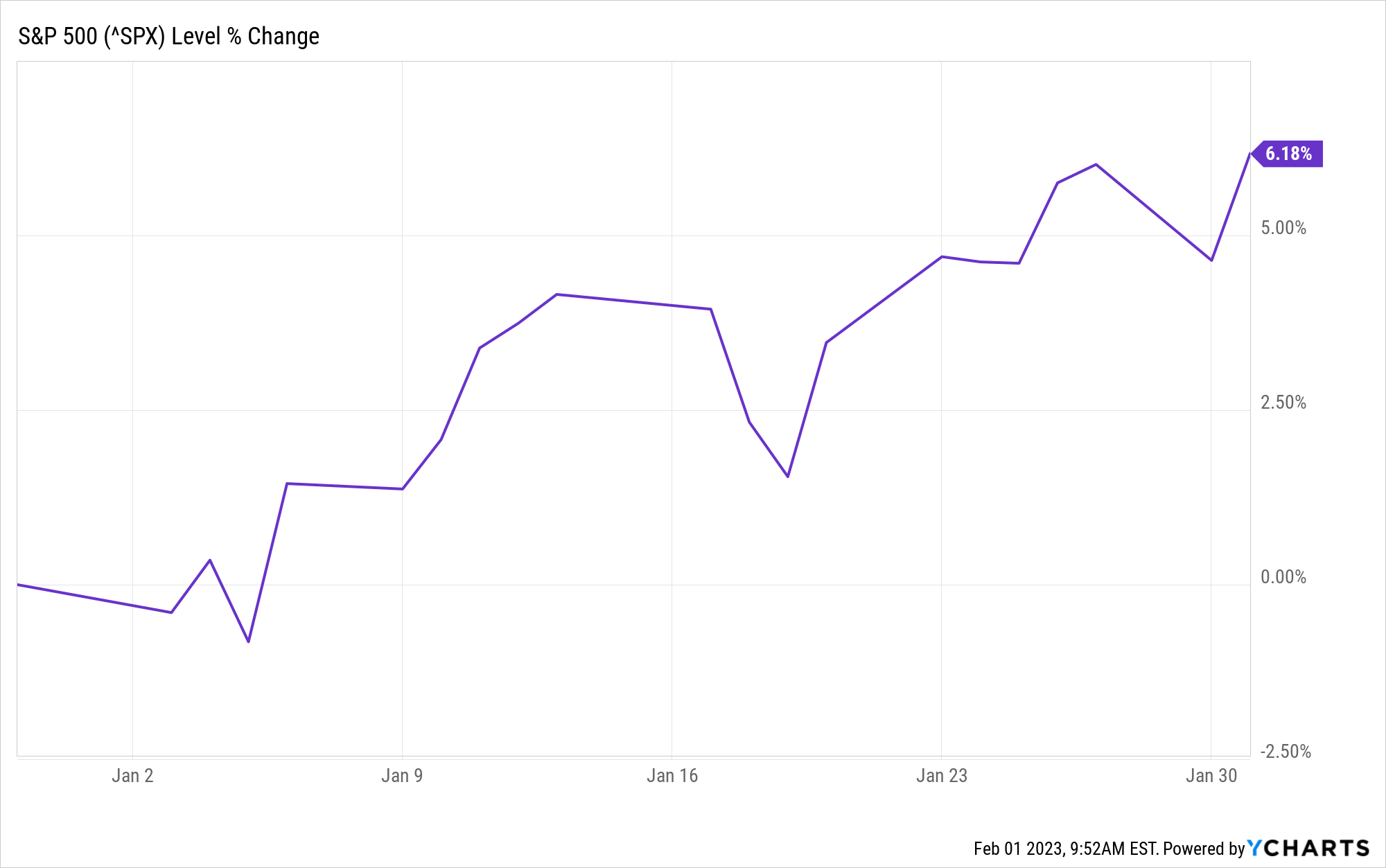

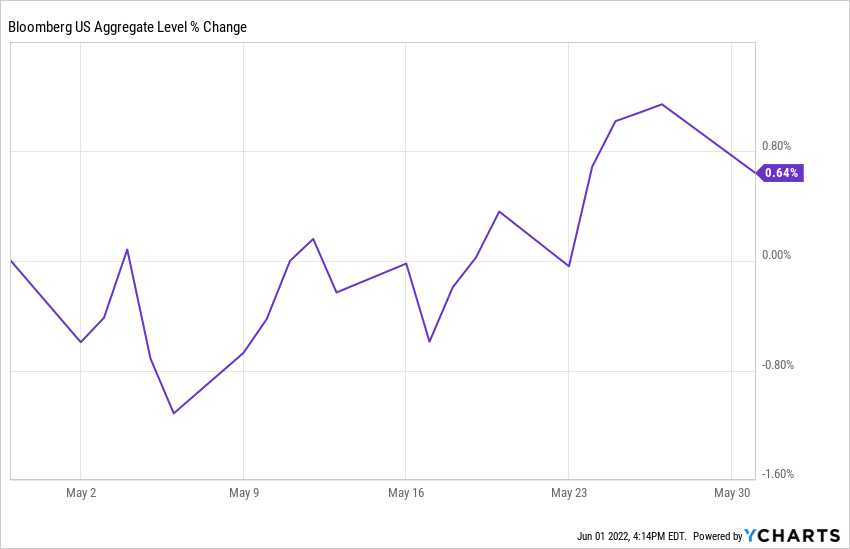

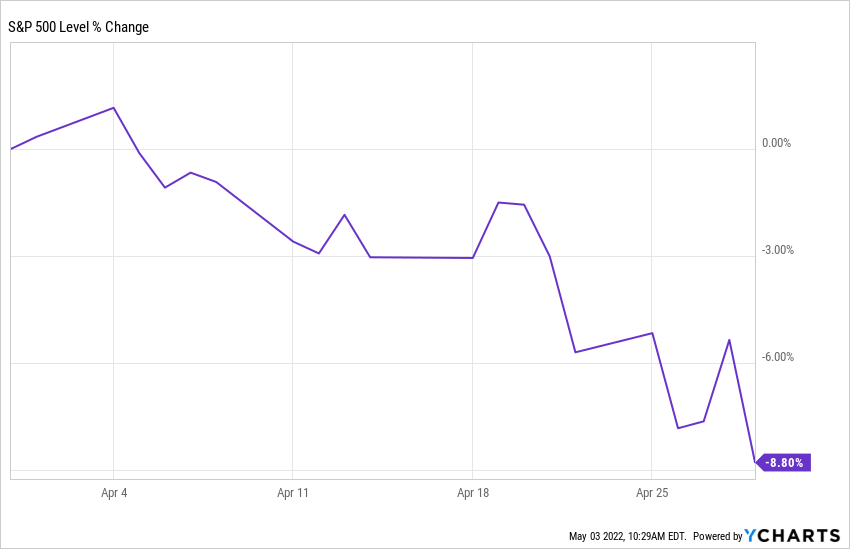

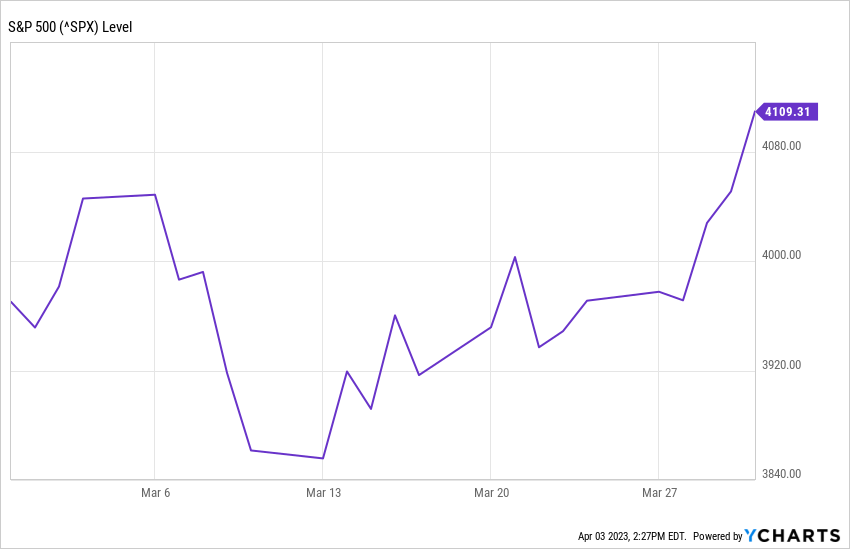

We saw increased volatility in stocks and bonds in March, as the S&P 500 rallied to finish the month up about 3.5%. (YCharts)

It was an eventful month of headlines, primarily with turmoil in the banking sector as two banks failed in three days. Concerns surrounding the banking system became the number one issue for investors, with the subsequent Fed meeting and rate decision a close second.

We’ve received a number of questions about the banking system and will tackle three of the biggest ones below:

- Are these failures systemic? At this point, we don’t believe these bank failures are a sign of widespread issues. One reason for this is that the cost to insure against banks failing increased (as expected), but remained below the levels we saw in 2020 and far below levels seen during the financial crisis. That said, we will continue to watch this sector carefully and be ready to make adjustments to portfolios if needed.